Market watch

Indian stocks still offer good long-term growth prospects in Asia

Issue date: 2024-07-26

abrdn

Investing in emerging markets is always a balancing act, between the promise of high growth potential that is often tempered by a degree of inherent uncertainties present in the market. One country that has given investors plenty to cheer in recent years has been India. In this article, we will discuss the opportunities and risks associated with the market and whether it is still an attractive place to invest.

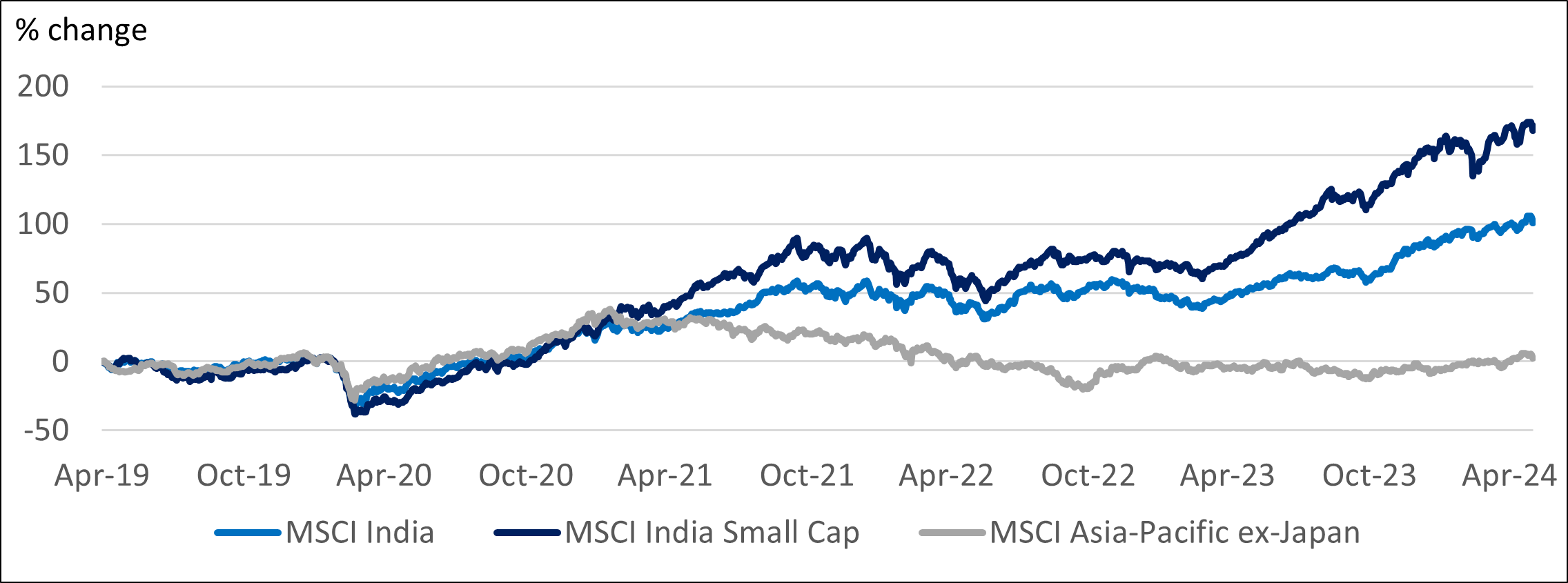

While the Indian stock market has forged ahead, far outpacing the performance of emerging market peer China and the broader Asia-Pacific region (chart 1), the country’s economic trajectory is also on the rise, being one of the fastest-growing major economies in the world (chart 2). India’s current macroeconomic strengths are well known: a real estate boom, a robust infrastructure capital expenditure (capex) cycle, supportive government policies and the positive effects of a decade of painful, but necessary reforms that have reduced the cost of doing business.

Chart 1: India has outperformed Asia-Pacific since 2021

Chart 2: India is one of the fastest-growing major economies in the world

*based on provisional estimates

Though India’s corporate landscape tends to operate on a glass-half-full basis, the buoyant mood on the ground and among companies is not unfounded. Multiple trips to the country in recent months have affirmed our confidence in the viability of this growth story – a stark contrast to the prevailing global sentiment. This is largely due to a period of sub-par growth in the years before the Covid-19 pandemic. Just as things were starting to look up, the pandemic hit, further derailing the momentum. The Indian economy is playing catch up now, supported by attractive macroeconomic drivers.

Supportive fiscal policy, crucial reforms

Over the past decade, India has enjoyed largely supportive policies from the central government. This period has also seen key structural reforms, such as the introduction of the Goods and Services Tax (GST) which has significantly enhanced tax revenue, initiatives in the real estate sector to make housing more accessible, and improvements in bankruptcy laws to streamline the resolution of corporate insolvency problems.

In recent years, these reforms have paved the way for increased public sector investment in essential infrastructure projects, including the development of roads, railways, and ports. This not only is meant to generate employment but has been designed to encourage private sector capex while addressing logistical challenges within the country. Furthermore, since recovering from the pandemic, India has successfully maintained adequate fiscal discipline, alleviating investor concerns about ballooning government debt seen elsewhere.

Election surprises

The outcome of India’s 2024 general election has, however, thrown up an unexpected surprise. Polls had predicted that Prime Minister Narendra Modi and his party would comfortably win enough seats in the lower house of parliament to form a government on their own. Instead, Modi and his Bharatiya Janata Party (BJP) has been pushed into a coalition government for the first time in his career.

What this means for future policymaking remains a little unclear. We think that BJP’s broad agenda around infrastructure, manufacturing, and technology would likely continue, and that will be beneficial for the economy. New, big bang reforms, however, are unlikely to come from a coalition government. Instead, there could be a shift towards policies that cater to populist agendas, possibly accompanied by a moderation in public capex. Efforts may focus on creating jobs nationwide and addressing the sluggish demand within the rural economy, still recovering from the pandemic’s effects, which could have beneficial long-term outcomes.

Although the Indian market might have relinquished some of the political stability premium it enjoyed due to Modi and the BJP’s widespread domestic appeal since the last election, the trajectory of economic growth is expected to remain steady, barring unforeseen events.

Corporate health and rich valuations

Corporate India is in a relatively good shape at this moment. Real estate, particularly the residential segment, is experiencing robust growth. Indian banks stand strong with healthy balance sheets, albeit facing some recent short-term challenges related to liquidity and future prospects for loan growth. Furthermore, Indian companies reported a healthy earnings growth of 20% in fiscal year 2023-2024[1] that ended in March.

Anecdotal evidence gathered from our conversations with various companies have consistently backed up this positive outlook. We have met numerous management teams on multiple trips to India to gather on-the-ground information and the majority of the business leaders have been positive on both the state of the economy and policy direction. All this is helping to sustain attractive earnings growth and a recovery in return on equity, which is encouraging as high corporate valuations in India leave less margin for error. Corporate debt, moreover, is expected to shrink once a private capex cycle is fully underway.

The strength in the domestic economy as well as companies broadly delivering on earnings have left the Indian market looking quite full on near-term multiples. Some parts of the market are looking hotter than usual, particularly among smaller and mid cap companies that have benefitted from strong domestic flows, which have pushed up share prices. These days, India is trading close to its 10-year high price-to-earnings ratio, but the premium above this average level is not particularly stretched, whilst corporates are expected to generate 12% to 15% earnings growth over the medium term. While there is no catalyst for a slowdown anytime soon – high growth is likely to continue to support earnings – we can still see some areas taking a pause.

Green Economy and Renewable Energy

India is making significant strides in the green economy and renewable energy sector. During the COP26 summit held in Glasgow, India pledged to reach net-zero emissions by the year 2070, setting a challenging yet vital target for its status as a developing economy. To meet this target, India has set interim goals for renewable energy generation by 2030, positioning itself as a leading player in renewable energy expansion.

While the green economy presents promising opportunities, navigating India's public markets for direct investments can be challenging. Few listed companies align directly with this theme. However, investors can explore opportunities indirectly through industrial companies providing components and services to the renewable energy sector. Our portfolio is positioned accordingly to take advantage of those structural trends.

Risks to Consider

India still faces some near-term risks, most of which stem from external factors such as the potential for increased global energy prices and a slowdown in the world economy. As a country that imports a significant amount of its oil, heightened tensions in the Middle East could pose a concern, with the threat of escalated conflict potentially causing energy prices to surge. Geopolitics also remain a consideration for investors, though India’s international standing is comparatively robust, supported by strong bilateral and multilateral relationships, including those with the United States.

Market valuations can sometimes get out of hand, particularly when a stock’s price increase is not supported by an improvement in the medium and long-term outlook. This was exemplified early in 2023 when the Adani Group was targeted by a US-based short seller whose report accusing the conglomerate of fraud and price manipulation led to a significant erosion of market value for Adani’s companies following their exceptionally strong run in the preceding year.

A Multi-Faceted Investment Opportunity

Although India is a relatively more expensive market, there are still sectors that present appealing opportunities for investors. Besides the positive ongoing trends around real estate and infrastructure development that is enabling both domestic growth and attracting foreign direct investments, India’s demographic dividend is also encouraging – a rising middle class that is increasingly becoming wealthier with access to technology due to penetration of smartphones and internet connectivity.

Our portfolio has significant exposures to these structural trends including premium consumption, capital expenditure and related sectors, real estate and related sectors, health care and wellbeing, while we are always on the lookout for new ideas around green transition. We are, however, cautious about the near-term prospects for rural consumption demand, leading us to take a relatively lighter position on consumer staples. Additionally, due to the uncertainties surrounding the global economy, we hold a less optimistic view on export-driven sectors.

[1] Goldman Sachs, India 2Q outlook, 31 March 2024

Important Information This document is strictly for informational purposes only and does not constitute an offer to sell, or solicitation of an offer to purchase any security, nor does it constitute investment advice, investment recommendation or an endorsement with respect to any investment products. |