Market watch

Asia in review: Long-term remains resistance, with grounds for optimism

Issue date: 2024-01-03

First Sentier

The Asian Fixed Income market faced some challenges in the second half of 2023. China’s slowdown loomed like a dark cloud over the horizon even as the US economy printed strong numbers that portrayed strong consumption, wage growth and still low unemployment numbers. There are more downgrades than upgrades in the overall Asian credit space, but fundamentals have remained mostly intact amongst high quality credits. In supply technicals, the primary market issuance for Asian Credit remains extremely slow, providing additional price support for credits as tightening spreads helped offset the rise in interest rates.

Meanwhile in the Asian equity markets, investors have gone from “anything, as long as it’s China” to today’s high levels of fear and disbelief, but that is typical when markets fall significantly. There are reasons for investors to be cautious – with lower demand, higher debt, de-coupling and demography being the more obvious issues. In Asia, there has been a “lost decade” across much of the region, with low single-digit annualised returns for the last decade (2013-2023) compared with the double-digit returns of the previous decade (2003-2013). 1 For example, Indonesia and China have returned a paltry 2.4% and 1.2% annualised respectively over the last 10 years, while the Philippines and Malaysia have been negative. [Figure 1] But, lower prices are usually synonymous with higher returns; and First Sentier Investors’ Asia equities specialist team - FSSA Investment Managers (FSSA) believes there are long-term tailwinds for the ASEAN region.

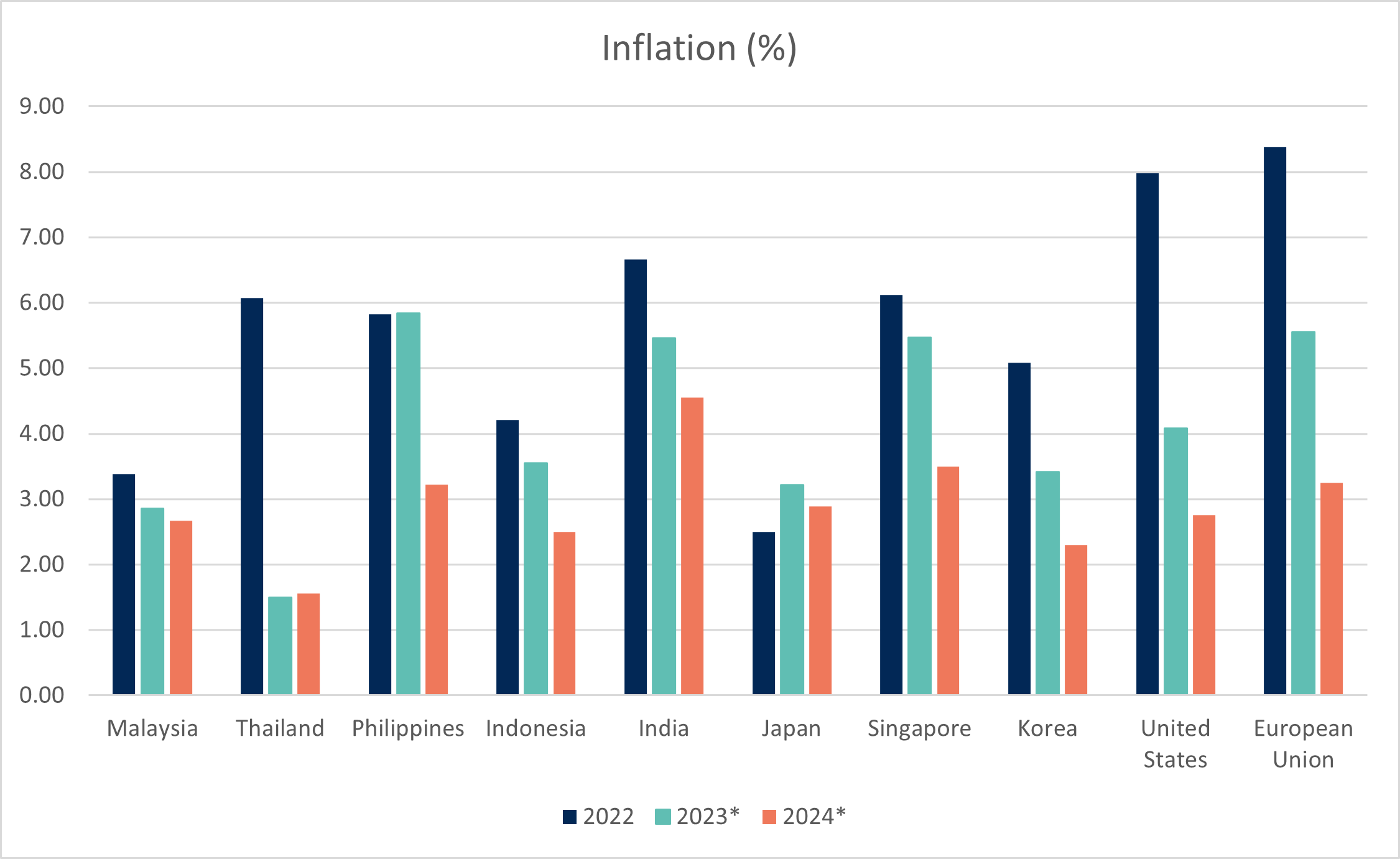

Inflation continues to trend lower in Asia [Figure 2]

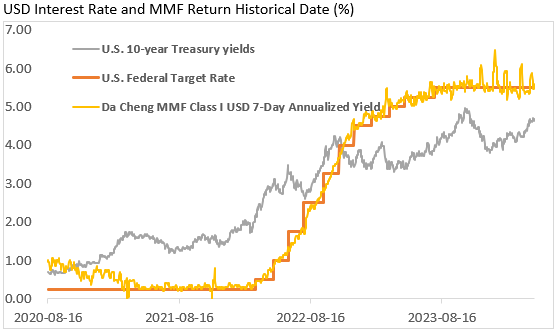

In the US, First Sentier Investor Asian Fixed Income team (“the team”) believes we are close to the end of the current rate hike cycle and cooling signs in core inflation numbers offer the Fed an opportunity to take a pause and assess the impact of the past year of rate hikes before deciding on their next step. Bank of Japan’s next move should be closely watched as any signs of change to its Yield Curve Control policy will have significant implications for the course the dollar’s strength. Within the region, the team has turned cautious on Asian currencies as they are now vulnerable to a US, China or global recession scenario as risks and uncertainties continue to mount.

Inflation in Asia has been fairly under control when compared to developed markets, giving Asian central banks more flexibility to pause rate hikes and potentially cut rates to spur growth should the need arise. There are clear signs that inflation in most Asian countries are likely to continue trending lower, unless food and energy inflation rear its ugly head and cause a spike in headline inflation. The team remains constructive on the region’s longer-term growth prospects as Asian economies continue to move up the value chain in the global economy.

Is China's slowdown rattling Asian economies?

China’s slowdown has led to ripple effects across Asian economies. The growth outlook in Asia is showing signs of weakness especially for exports oriented countries including Singapore, South Korea and Taiwan. Barring a major stimulus from China, headwinds from China’s slowdown would inevitably mean a prolonged period of weak exports numbers from Asian economies. Countries with a stronger domestic story, such as India and Indonesia, are likely to fare better.

The fall of industry stalwarts in China’s property space has been alarming. Until Chinese regulators come through with stimulus significant enough to inject optimism to the property market and increase property sales, default risk remains high among private and mixed ownership developers. With continued weakening of technicals and deteriorating fundamentals, the team sees a low probability of strengthening in the property sector in the short term. On the upside, albeit painful, this would also mean an acceleration of the consolidation of China’s property sector in the longer run.

Eyes on the High Quality Asian Credit

With signs of slowing earnings and weaker economic activity in the region, fundamentals of Asian Investment Grade (IG) corporates remain sound. Conservative balance sheet management along with sticky cash generation continued to anchor Asia Investment Grade (IG) credit fundamentals. Average IG corporates’ interest coverage remained prudent at 11x with resilient earnings and steady funding costs. Strong liquidity buffers (ample cash on hand and unused credit lines) remain a key credit strength for most companies.

Considering the mounting macro uncertainty, valuations are starting to look rich, despite modest weakening in Asian IG credit metrics within still solid territory. Nevertheless, high all-in yields well above 5% does makes this asset class attractive from an income carry perspective. Compared to US IG, Asian IG offers wider spread with more attractive yield lower volatility.

Asia equities: What are the investment themes to watch?

Despite the volatility around the Asia equities market, with the rise of a newly emerging middle-class and improving corporate governance, FSSA believes that the below investment themes in Asia Pacific still present attractive investment opportunity set for investors:

- Dominant consumer franchises

With favourable demographics and populations that are still growing – particularly in Southeast Asia and India – FSSA believes dominant consumer franchises can offer good growth potential over the long term.

- Rise in healthcare spending

Many countries are under-invested in healthcare compared to the global average. As these economies become richer, FSSA expects healthcare and health-related spending to rise.

- High quality financials

FSSA believes banks and high quality financials should benefit from similar drivers as consumer businesses: demographics, rising incomes and urbanisation.

- A more connected and automated world

As the world embraces a digital future, FSSA believes Asian technology firms should benefit from strong end demand and a growing market. At the same time, lower-cost robots allows manufacturers to automate their processes.

China + 1 – the evolution of South East Asia

Southeast Asia is the third largest working population bloc after India and China. With the exception of Vietnam, this “demographic dividend” has been more of a dream than reality for the region over the last two decades, as manufacturing was either hollowed out (e.g., the electronics-makers in Malaysia) or never took off due to China’s rise as the “the world’s factory”. As geopolitics force global and Chinese companies to rethink their supply chains, the team believes Southeast Asia could stand to benefit.

However, this shift will take time. In one of our company visit in Thailand, FSSA found that although there is interest from global customers, the issue is one of price. Electronics-related manufacturing in China is efficient and done at scale; and there is a 15-25% price differential for customers to digest. In addition to that, a local ecosystem of suppliers also needs to redevelop in Southeast Asia.

The tailwinds are real, but as bottom-up investors, FSSA has struggled to find quality companies with sufficiently attractive risk-reward. The excitement has resulted in sky-high valuations of a handful of direct beneficiaries, and the scarcity premium (i.e., the lack of companies worth investing in) is well outside the comfort zone.

Rise of India

India is one the oldest stock markets in the world. With one of the largest populations in the world and increasing levels of urbanisation, India makes an attractive investment destination for long-term growth as the economy continues to develop, especially the followings:

- Aspirational consumer base

Favourable demographics and under-penetrated categories2, lead to well-positioned consumer franchises generating high Returns on Capital Employed (ROCE)3. FSSA believes such dominant franchises will keep gaining market share as the markets formalise as well as premiumise over time.

- Financial Inclusion

FSSA believes well-managed private sector banks should continue to benefit from greater penetration of financial services across India. They should continue gaining market share at the expense of poorly run and under-capitalised state-owned banks.

- Infrastructure Improvement

With greater need for better quality infrastructure as the country develops, FSSA believes that suppliers, such as paints and cement companies, will benefit. Well-run companies in these industries typically generate high returns and have low debt compared to infrastructure asset owners.

Figure 1 – Annualised returns in USD

Figure 2 – Lower inflation

1 Source: MSCI, Bloomberg, comparing annualised returns over the 10 years to 31 October 2023 and 10 years to 31 October 2013.

2 Under-penetrated categories mean categories or products and services that are still not widely used by consumers.

3 Return on capital employed (ROCE) is a financial ratio that can be used in assessing a company's profitability and capital efficiency.

Source: Company data retrieved from company annual reports or other such investor reports. Financial metrics and valuations are from FactSet and Bloomberg. As at November 2023 or otherwise noted.

Important information The information contained within this material is generic in nature and does not contain or constitute investment or investment product advice. The information has been obtained from sources that First Sentier Investors (“FSI”) believes to be reliable and accurate at the time of issue but no representation or warranty, expressed or implied, is made as to the fairness, accuracy, completeness or correctness of the information. To the extent permitted by law, neither FSI, nor any of its associates, nor any director, officer or employee accepts any liability whatsoever for any loss arising directly or indirectly from any use of this material. This material has been prepared for general information purpose. It does not purport to be comprehensive or to render special advice. The views expressed herein are the views of the writer at the time of issue and not necessarily views of FSI. Such views may change over time. This is not an offer document, and does not constitute an investment recommendation. No person should rely on the content and/or act on the basis of any matter contained in this material without obtaining specific professional advice. The information in this material may not be reproduced in whole or in part or circulated without the prior consent of FSI. This material shall only be used and/or received in accordance with the applicable laws in the relevant jurisdiction. In Hong Kong, this material is issued by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong. In Singapore, this material is issued by First Sentier Investors (Singapore) whose company registration number is 196900420D. This advertisement or material has not been reviewed by the Monetary Authority of Singapore. First Sentier Investors, FSSA Investment Managers, Stewart Investors, Realindex Investments and Igneo Infrastructure Partners are the business names of First Sentier Investors (Hong Kong) Limited. First Sentier Investors (registration number 53236800B), FSSA Investment Managers (registration number 53314080C), Stewart Investors (registration number 53310114W), Realindex Investments (registration number 53472532E) and Igneo Infrastructure Partners (registration number 53447928J) are the business divisions of First Sentier Investors (Singapore). First Sentier Investors (Hong Kong) Limited and First Sentier Investors (Singapore) are part of the investment management business of First Sentier Investors, which is ultimately owned by Mitsubishi UFJ Financial Group, Inc. (“MUFG”), a global financial group. First Sentier Investors includes a number of entities in different jurisdictions. MUFG and its subsidiaries are not responsible for any statement or information contained in this material. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment or entity referred to in this material or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested. |