Education series

What are Senior Secured Bonds?

Barings

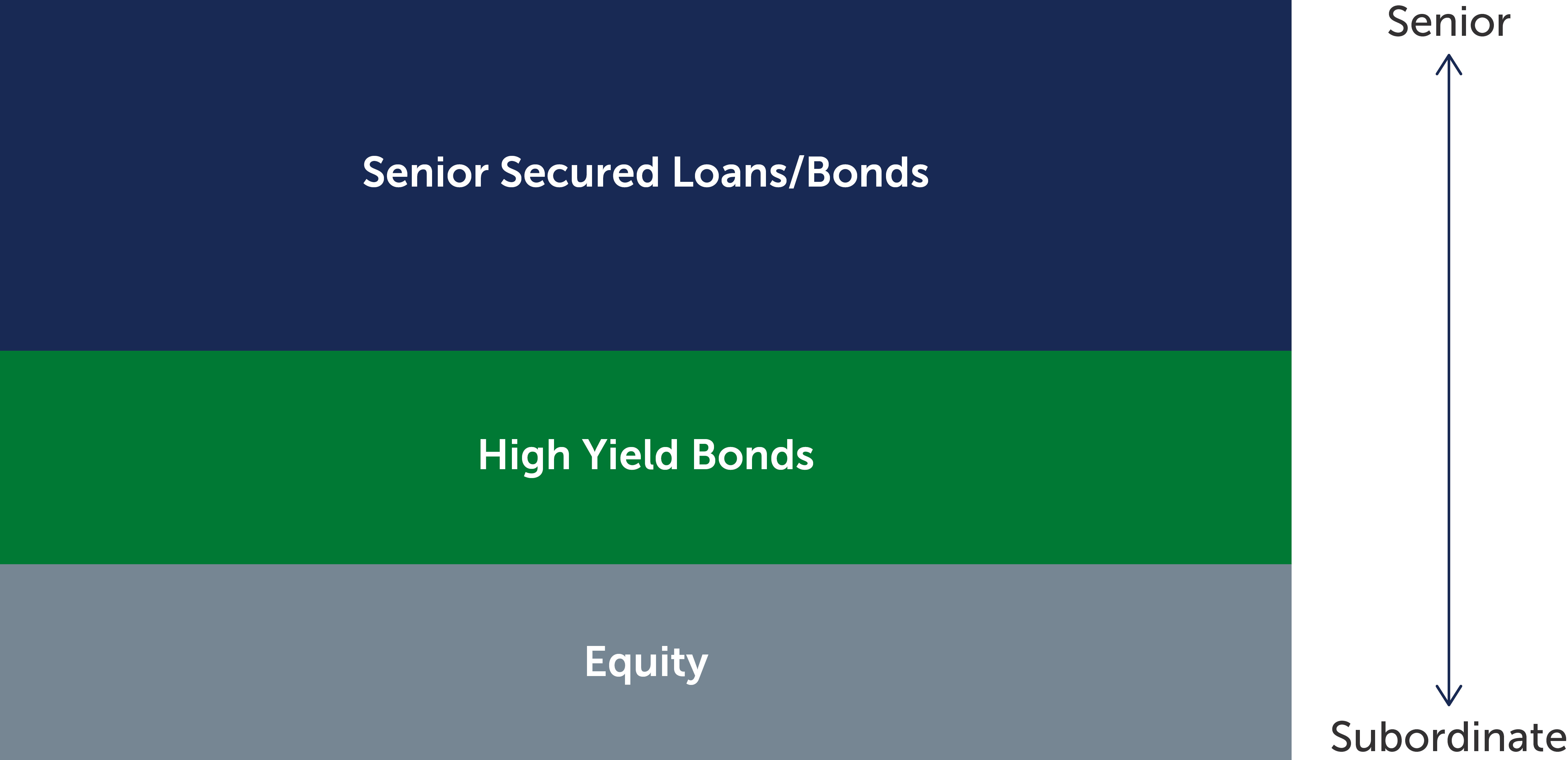

A bond is a debt obligation sold to investors. If a corporation defaults on its obligations, it can be forced into bankruptcy liquidation, in which case its assets are sold off to repay its debts. Debts are repaid in a prescribed order of priority. “Senior” debt is repaid first, ahead of junior, or subordinated, debt. If a bond is classified as “secured”, it is backed by issuer collateral, or some form of assets. Therefore, senior secured bonds are high yield bonds that are both senior and secured in the capital structure (Figure 1).

Figure 1: Global Senior Secured Bonds Offer Capital Structure Seniority

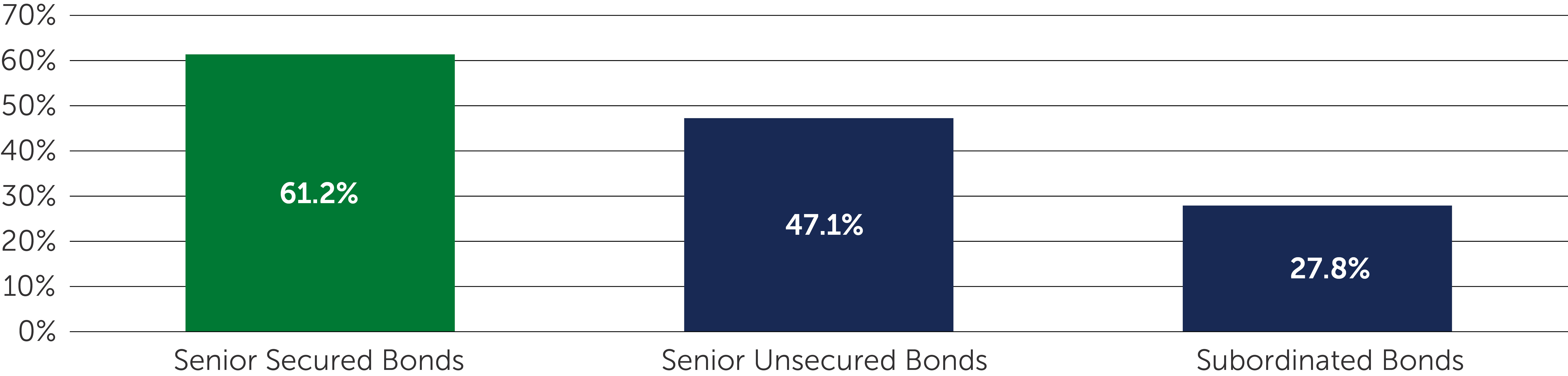

Senior secured high yield bonds for North American non-financial companies have historically offered higher recovery rates relative to unsecured bonds. During the period from 1987–2022, the average recovery rate for defaulted senior secured bonds was 61.2%, compared to 47.1% for senior unsecured bonds and 27.8% for subordinated debt (Figure 2).

Figure 2: Senior Secured Bonds Have Historically Offered Higher Recovery Rates

The senior secured bond market has experienced substantial growth over the last decade, the value of the market is around US$515 billion, equivalent to about one third of the global high yield bond market1.The growth of the asset class is largely due to its emergence as a viable source of funding for companies as other capital-raising avenues—including loans and unsecured bonds—faced limitations.

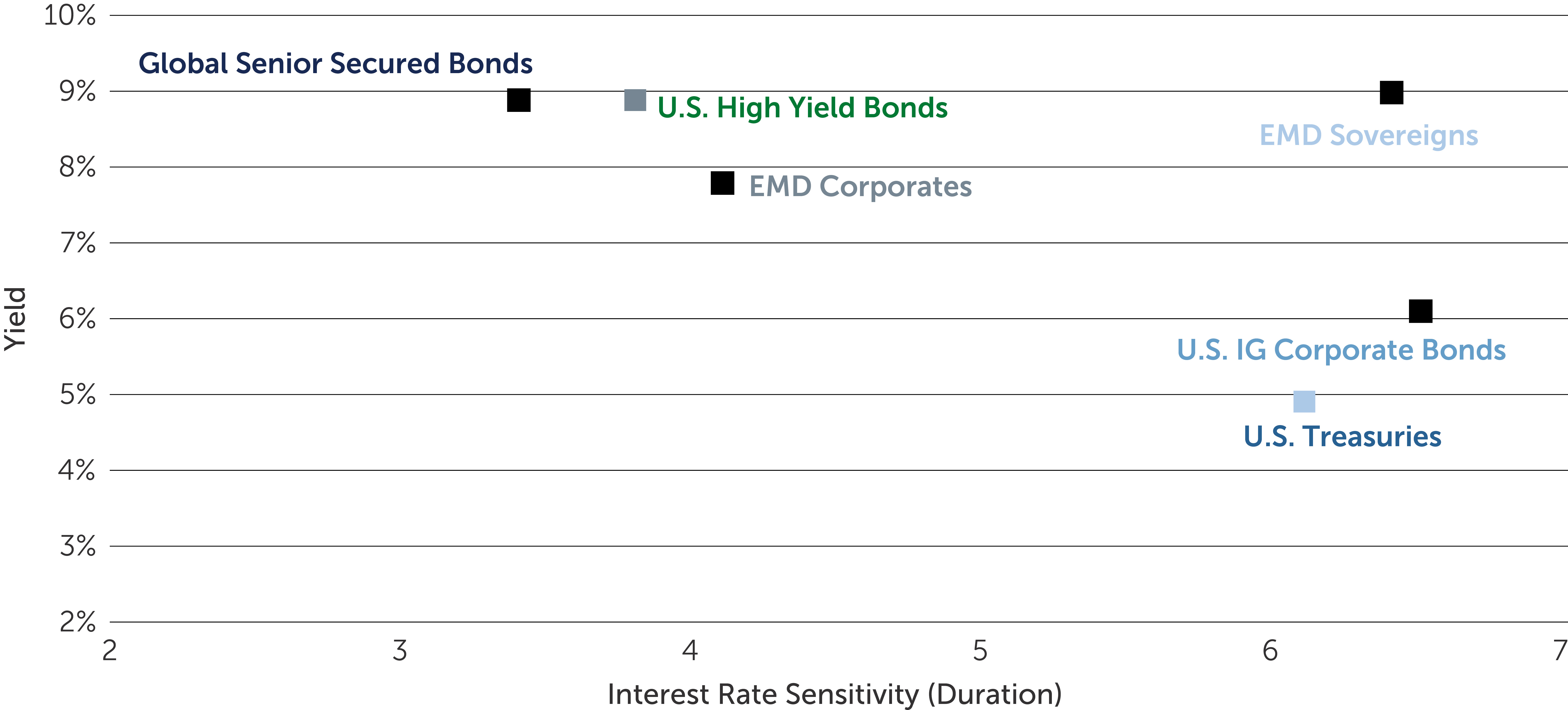

On the other hand, senior secured bonds exhibit relatively low sensitivity to interest rate moves as evident by the low duration profile. This relationship can also be observed via the historically low and often negative correlation across total returns between the global senior secured bond asset class and U.S. Treasury bonds. That said, interest rate sensitivity can vary considerably on a more bottom-up basis across specific credits, sectors and ratings, which warrants careful security selection.It is also worth noting the relatively shorter maturity profile of the global senior secured bond market—less than 1% of the market has a maturity profile greater than 10 years2.

Figure 3: High Yield Prospects With Limited Interest Rate Sensitivity

Further, while senior secured high yield bonds are not recession-proof, they are higher in the capital structure than unsecured bonds, which means they can offer investors greater protection from principal loss in the event that a company defaults. The asset class, like traditional high yield bonds, is sensitive to the credit fundamentals of the issuing company, and economic slowdowns can put pressure on corporate cash flows and/ or profitability.

Senior secured high yield bonds, like traditional unsecured high yield bonds, tend to be more highly leveraged than their investment grade counterparts and, therefore, may be more vulnerable in a recession. However, managers may seek to mitigate the credit risk associated with below investment-grade debt by carefully analyzing the fundamentals of the issuer and assessing the collateral attached to the bond.

1 Source: ICE BofA. As of September 30, 2023.

2 Source: ICE BofA. As of September 29, 2023.

Important Information The document is for informational purposes only and is not an offer or solicitation for the purchase or sale of any financial instrument or service. The material herein was prepared without any consideration of the investment objectives, financial situation or particular needs of anyone who may receive it. This document is not, and must not be treated as, investment advice, investment recommendations, or investment research. In making an investment decision, prospective investors must rely on their own examination of the merits and risks involved and before making any investment decision, it is recommended that prospective investors seek independent investment, legal, tax, accounting or other professional advice as appropriate. Unless otherwise mentioned, the views contained in this document are those of Barings. These views are made in good faith in relation to the facts known at the time of preparation and are subject to change without notice. Parts of this document may be based on information received from sources we believe to be reliable. Although every effort is taken to ensure that the information contained in this document is accurate, Barings makes no representation or warranty, express or implied, regarding the accuracy, completeness or adequacy of the information. Any forecasts in this document are based upon Barings opinion of the market at the date of preparation and are subject to change without notice, dependent upon many factors. Any prediction, projection or forecast is not necessarily indicative of the future or likely performance. Any investment results, portfolio compositions and/or examples set forth in this document are provided for illustrative purposes only and are not indicative of any future investment results, future portfolio composition or investments. The composition, size of, and risks associated with an investment may differ substantially from any examples set forth in this document. No representation is made that an investment will be profitable or will not incur losses. Where appropriate, changes in the currency exchange rates may affect the value of investments. Investment involves risks. Past performance is not a guide to future performance. Investors should not only base on this document alone to make investment decision. This document is issued by Baring Asset Management (Asia) Limited. It has not been reviewed by the Securities and Futures Commission of Hong Kong. |