Education series

1 Minute to Understand Money Market Funds

Da Cheng International

With recent returns on money market funds being relatively good, many investors are likely to be more interested in these funds. In this brief overview, we'll provide a quick introduction to what Money Market Funds are and what they offer.

What is Money Market Fund (the “MMF”)? What do MMFs invest in?

A MMF is a type of investment scheme that invests in high-quality, short-term instruments and seeks to provide returns comparable to those of the money market. Specifically, the main underlying investments of MMFs include deposits, certificates of deposit, time deposits, and high-rated short-term bonds.

What are the characteristics of money market funds?

In order to accommodate the development of MMF products, the Securities and Futures Commission of Hong Kong issued a revised Code on Unit Trusts and Mutual Funds (the “UT Code") on 1 January, 2019, which updated the requirements for MMFs.

Revolves around the characteristics of MMFs and in conjunction with market demand and regulatory considerations, the UT Code sets out a number of mandatory requirements, for example:

- Short Average Maturity: a MMF must maintain a portfolio with weighted average maturity not exceeding 60 days

(e.g. if half of the assets in the MMF are time deposits maturing after 30 days and the other half are time deposits maturing after 90 days, the weighted average maturity of the portfolio would be 30 days x 50% + 90 days x 50% = 60 days). - Single Underlying Maturity Requirement: In addition to the weighted average maturity requirement, for any one investment instrument, a MMF must not purchase an instrument with a remaining maturity of more than 397 days, or two years in the case of Government and other public securities.

- Liquidity requirements: MMFs could be redeemed on a daily basis and therefore the UT Code requires that must hold at least 7.5% of its total net asset value in daily liquid assets and at least 15% of its total net asset value in weekly liquid asset.

This means that in the event of a large redemption of a MMF, assets equivalent to at least 7.5% of the market value are available for liquidation on the same day at a price close to the market price to meet the redemption demand.

Therefore, the underlying investment of MMFs is characterized by short maturity, relatively stable price and easy liquidity. MMFs can provide significantly better liquidity than time deposits while achieving returns similar to time deposits.

Income characteristics of MMFs: Seeking to offer returns in line with money market rates

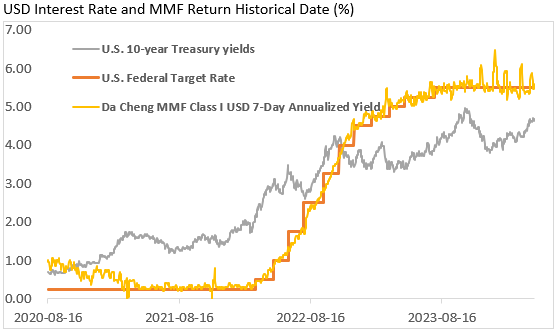

The positions of MMFs are predominantly time deposits, and therefore the return rate is affected by the money market interest rates of the currencies in which the main assets are denominated. Assuming a MMF mainly invests in US dollar-denominated money market instruments, and over the past period of time, the Federal Reserve's interest rate hike has led to a gradual upward trend in the fund's yield:

7-Day Annualized Yield(%) = (NAV on T+8 – NAV on T+1) / NAV on T+1 / 7 * 365 * 100%.

Note: T+N = the N th natural days after T-day.

Data Source: Winds, Da Cheng International, as of the end of April 2024

What are the differences between MMFs issued in Hong Kong and the Mainland?

The main difference is valuation methods: MMFs issued in the China Mainland are valued using the amortized cost method , and the price trend of the fund is upward usually; whereas the Hong Kong market has more stringent requirements on the use of the amortized cost method for money market funds, so all MMFs issued in the market at present are valued using the market price method, which, in the event of drastic fluctuations in the market, will lead to relatively more fluctuations in the prices of MMFs that have invested in bonds.

Under what circumstances is it appropriate to allocate MMFs?

If you have a good understanding of MMFs and have unused funds, it is always a good idea to consider investing in MMFs at any time.

But in a high interest rate environment, in addition to investing your unused funds, you can also consider allocating a larger part of assets in MMFs to get a relatively good return while taking relatively low risk. And when the Fed initiates a period of falling interest rates, consider switching from money market funds to bond assets (e.g., short-term bond strategy funds, etc.) assuming that the liquidity needs are not taken into account.

| Risks Disclosures: Investment involves risks. The content of this page is for general purpose only, and does not constitute any offer or solicitation to offer of any fund product. Investor should read the fund’s offering documents including risk factor information before making any investment decision. Past performance is not indicative of future performance, may not be achieved by the fund in future. The subject fund is authorized by the Securities and Futures Commission but SFC authorization does not imply official recommendation. This material is issued by Da Cheng International Asset Management Company Limited and has not been reviewed by the Securities and Futures Commission. |