Education series

Market Outlook for Q4 2024

Taikang Hong Kong

The Federal Reserve cut interest rates by 50bp in its September meeting. Compared with the previous meeting statement, this statement emphasized maximizing employment, and the focus of monetary policy may be inclined to the labor market. This substantial interest rate cut shows that Fed officials have a low tolerance for rising unemployment, and may maintain a dovish stance before the job market stabilizes.

Fed Powell balanced the dovish signals at the press conference saying that the US economy is good and growing steadily, with a strong labor market, and the Fed is not behind the curve. The overall tone of the press conference was neutral.

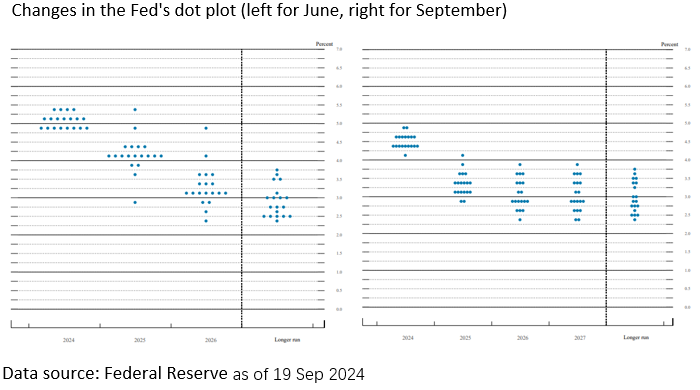

Looking forward, the Fed has cut interest rates significantly, and there is ample room for future interest rate cuts, which may increase the probability of a "soft landing" of the US economy, but the risk of inflation may also increase. According to the latest dot plot guidance, there will be 2 more interest rate cuts (50bp) this year, 4 interest rate cuts (100bp) in 2025, and 2 interest rate cuts (50bp) in 2026, and the pace of interest rate cuts has been significantly advanced to this year and next year, becoming closer to market expectations. The Fed's baseline scenario is that the US economy will grow by 2%, the unemployment rate will be 4.3%, and the core personal consumption expenditure (PCE) will be 2.2% by the end of 2025. This set of forecasts is relatively reasonable. The Fed expects GDP growth to be 2% in 2025, which, despite the downward revision, is still slightly higher than its long-term growth forecast of 1.8%. In other words, the Fed may believe that the current planned easing speed can bring about appropriate economic results.

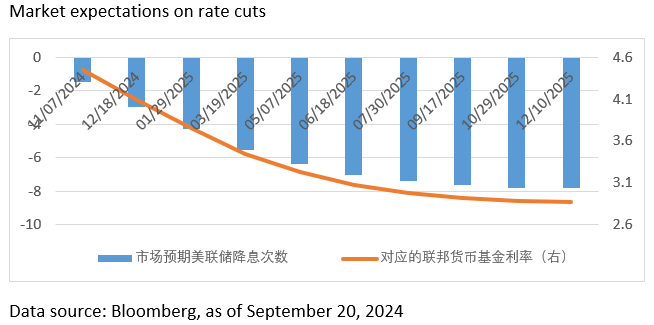

There is still uncertainty about the future path of interest rate cuts, which may bring continued market volatility. The market has already priced in a considerable amount of easing. As of September 19, 2024, the market expects about 3 interest rate cuts in 2024 and about 5 interest rate cuts in 2025, with 4Q25 being the last. The Fed continues to observe the constantly updated economic data and will decide on the policy interest rate at future meetings. At the press conference after the September interest rate meeting, Fed Chairman Powell also mentioned that the "dot plot" is a forecast, not a plan. This 50bp rate cut is a re-precision of the policy. Powell said that the speed of future rate cuts depends on economic development, which can be accelerated, slowed down, or suspended. Fed officials also have differences on the path of rate cuts. For the next rate cut in 2024, the median is 2 more rate cuts in 2024, but Fed officials have large differences. 2 predict no rate cuts, 7 predict 1 rate cut, 9 predict 2 more rate cuts, and 1 predicts 3 rate cuts. It is believed that the specific rate cut path will depend on updated income data, evolving economic outlook and balance of risks.

The Fed's forecast for long-term interest rates continues to rise, from 2.5% in December 2022 to the latest forecast of 2.9% in September, which means that the neutral interest rate may rise. Over time, the Fed will adjust its policy to a more neutral level, and the end point of the interest rate may not be too low. Considering that the rate cut may be limited and that the rate cut will re-support growth, it is difficult for policies to be further relaxed unless the US economy slows down beyond expectations.

In the future, the market will continue to play the game of betting rate cut paths, which may bring about large fluctuations in US Treasury bonds. Long-end US Treasury yields may continue to fluctuate in the future, and the risk is biased to the upside. Considering the current optimistic inflation expectations and the potential recovery of future demand (tariffs, loose monetary and fiscal policies, etc.), the US Treasury yield curve may further steepen, so the long end may be relatively unattractive, and the yield recovery may bring more opportunities.

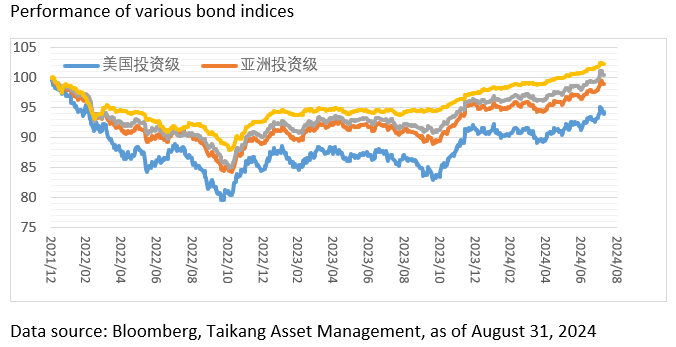

Affected by the downward trend of US Treasury yields in the past period of time, Asian dollar bond yields have fallen from historical highs, but they are still attractive at an absolute level. In the future, as the rate cut cycle opens, the spread of Asian dollar bonds is expected to remain resilient. Based on the response of Asian credit to the rate cut cycle in the past, the spread is expected to remain tight. Under the basic situation that the US economy avoids a recession, the reaction of Asian credit markets is relatively mild, just like when the last rate cut cycle began in 2019. There are no obvious factors that will put pressure on Asia's credit performance. Emerging economies in the region, such as India, maintain strong growth momentum. China's real estate market is still weak, but with fiscal efforts and the implementation of steady growth policies, the economy is expected to gradually enter recovery. The credit fundamentals of investment-grade companies in the region are still strong, and the financing channels are unobstructed, with low onshore refinancing costs. Even in the case of a shallow recession in the US economy, the market supply and demand (market technical) level is still good and capital flows chasing yields, it is believed that Asian dollar bonds will still be well-supported, similar to the situation seen in the 2001 interest rate cut cycle. In this context, it is possible to consider selectively choosing issuers with better credit qualities and sufficient liquidity. Careful scrutiny and selection of bonds is still the key.

Among them, the overall fundamentals of overseas and especially Asian investment-grade bonds are sound, and the risk of default is lower than before. The yield of Asian investment-grade bonds is generally higher than that of bond markets in other parts of the world. Some Asian investment-grade entities with sound fundamentals, including China and India, have shorter durations and more attractive bond yields than the United States, providing many excellent investment opportunities for investment managers to operate. Investors can select investment managers who can under the stressful and volatile market periods, but still provide investors with less drawdown and more stable alpha returns in the past long economic cycles for more satisfactory results.

In general, US dollar bonds are an important part of a diversified investment portfolio. They can play a balancing role in diversifying risk under economic slowdown and geopolitical uncertainty, and are crucial for investors to achieve long-term returns. At the same time, seizing the window of interest rate cuts to invest in US dollar bonds can lock in the current historically high absolute yield level. In addition to coupon income, it is also conducive to obtaining capital gains brought by the steep slope of the US Treasury yield curve.

| Disclaimer Unless otherwise stated, all information contained in this document is as of the date of publication of the document. The above content is for reference only and is intended for general reading by clients of Taikang Asset Management (Hong Kong) Co., Ltd. ("Taikang Hong Kong"), and does not take into account the specific investment objectives, financial situation or any special needs of any particular recipient, nor should it constitute advice or an offer or solicitation to buy or sell any investment product. Any research or analysis used in the preparation of this document was obtained by Taikang Hong Kong for its own use and purpose and is from sources believed to be reliable as of the date of this document, but no representation or warranty is made as to the accuracy or completeness of data from third parties. Any forecasts or other forward-looking statements regarding future events or performance may not be indicative and may differ from actual events or results. Any opinions, estimates or forecasts may change at any time without prior warning. Taikang Hong Kong shall not be liable for any loss arising from the use of this document. The views, recommendations, suggestions and opinions in this document do not necessarily reflect the position of Taikang Hong Kong and may be changed at any time without notice. Taikang Hong Kong is not obliged to provide any updates on the relevant information or opinions. This document may not be copied, distributed or transmitted to any person without the prior written approval of Taikang Hong Kong. This document and the information contained in it may not be distributed or published in any jurisdiction where distribution and publication are prohibited. If you are not the designated recipient of this document, please do not continue to read this document and destroy it immediately. Investment involves risks. Past performance is not an indicator of future performance. This document is issued by Taikang Hong Kong and has not been reviewed by the Securities and Futures Commission. You should consult your investment advisor before deciding to invest. |