Education series

Q4 market outlook

Ping An of China Asset Management (Hong Kong)

China's economy continued to show signs of slow recovery in Q3, with the real estate market performing sluggishly and yet to bottom out, domestic demand remaining weak, and economic growth largely relying on external demand.

Fixed asset investment growth in the first seven months of this year slowed to its lowest level since the start of the year. Although the total retail sales of consumer goods in July exceeded expectations, the growth rate remains below pre-pandemic levels. Against the backdrop of a credit crunch, core inflation edged up slightly in July, its lowest level since January. In the first half of this year, total government spending in China decreased compared to the same period in 2023. The slowdown in export growth reflects a cooling of global demand, which has been a key driver of China's economic growth. Looking ahead, rising uncertainty in global demand combined with ongoing weakness in domestic demand could hinder China's ability to meet its annual growth target.

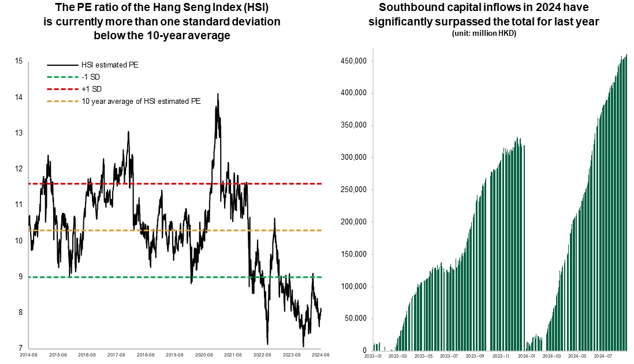

Given the challenges facing China in terms of economic fundamentals, the upside potential for the Hong Kong stock market may be limited. However, with the PE ratio of Hong Kong stocks close to one standard deviation below the 10-year average, and global allocations to Chinese assets having significantly reduced, these factors provide some support to the market. Furthermore, southbound capital inflows year-to-date have exceeded the total for last year, and this continued inflow also offers steady support to Hong Kong stocks. The Fed’s 50 bps rate cut in September is not only likely to create a more accommodative global monetary environment but also provide room for further rate cuts by the People's Bank of China. In a rate-cutting environment, the relatively low valuations of Hong Kong stocks make them more resilient compared to other markets. For the remainder of the year, economic data and corporate earnings are expected to improve on the low base from last year. Therefore, while Hong Kong stocks face certain upwards challenges, their downside risks remain relatively limited.

Given the current low inflation and macroeconomic slowdown, along with the approaching U.S. Presidential election season, market volatility is likely to increase. This environment favours allocating to low-volatility, highly defensive, high-yield strategies. In the current domestic environment of declining financing costs and investment returns, relatively predictable stock dividend cash flows can provide investors with stable income. Their bond-like characteristics also make them more attractive. During historical periods of declining interest rates, high-dividend stocks tended to outperform the broader market. Considering the current global economic slowdown, combined with domestic real estate market and geopolitical risks, an allocation strategy of high-dividend H-shares can help mitigate volatility and improve returns.

Data Source: Unless otherwise specified, all market data contained herein are from Bloomberg.

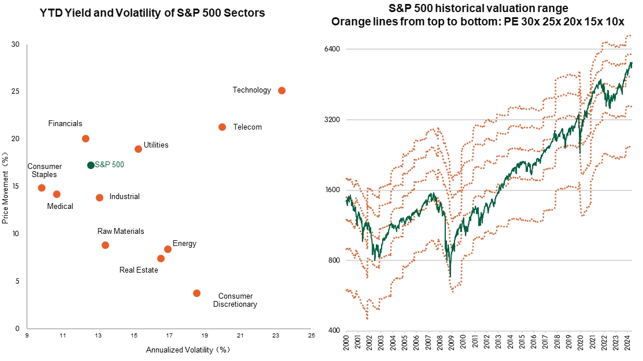

The latest U.S. CPI and PPI data have shown signs of stabilising, indicating a gradual decrease in inflation risks. The U.S. Federal Reserve announced a 50 bps rate cut following its September policy meeting, marking the first rate cut in more than four years and exceeding market expectations. Additionally, the dot plot projections suggest that the Fed anticipates an additional 50 bps rate cut later this year. Meanwhile, the upwards revision of Q2 U.S. GDP growth demonstrates some resilience in economic expansion. Strong retail sales data also reflect consumer resilience. Despite market volatility, Q2 earnings were strong, with most S&P 500 companies delivering EPS that significantly surpassed market expectations.

However, U.S. labour market data showed weakness, with rising unemployment and slowing wage growth. This has led to pessimism about future incomes and reignited concerns that consumer spending in the U.S. may slow down. Powell emphasised that measures will be taken to prevent further cooling in the labour market. The market broadly expects that the Fed will continue to cut rates for the remainder of the year, with unemployment potentially replacing inflation as the Fed's primary focus. As more labour market and other economic data are released, investors remain uncertain, wavering between expectations of a recession and hopes for a soft landing for the economy. Against this backdrop, volatility in the U.S. stock market is expected to rise significantly.

Given the high valuations of U.S. equities, uncertainty surrounding the U.S. macroeconomic outlook, and the upcoming U.S. Presidential election. Our overall view is that further upside potential for U.S. stocks is limited, while market volatility will persist.

At the same time, we still believe that an absolute return strategy through hedging is more solid and appropriate in the current diverged market environment. It can effectively reduce volatility while withstanding possible overheating or corrections in the market.

Data Source: Unless otherwise specified, all market data contained herein are from Bloomberg.

Disclaimer This video does not constitute an offer or solicitation by anyone in any jurisdiction in which such an offer or solicitation is not authorised or to any person to whom it is unlawful to make such an offer or solicitation. Any products or services referenced in this video (“Product”) may not be licensed in all jurisdictions, and unless otherwise indicated, no regulator or government authority has reviewed this video or the merits of the Product. The content of this video are for informational purposes only, and does not constitute or form financial advice to buy the Product. This video was prepared without regard to the specific investment objectives, financial situation or particular needs of any particular person. Investments involve risks. Past performance of any financial product does not guarantee future returns. Due to market volatility, most financial products are subject to market value fluctuations and the risk of loss of principal. Information herein has not been independently verified but is based on sources believed to be accurate and reliable as at the date it was made. Any projections or other forward-looking statements regarding future events or performance of countries, markets or companies are not necessarily indicative of, and may differ from, actual events or results. No warranty of accuracy is given and no liability in respect of any error or omission is accepted. Ping An of China Asset Management (Hong Kong) Company Limited (the “Company”) reserves the right to revise any information herein at any time without notice. The Company accepts no liability for loss arising from the use of the contents in this video. This video has not been reviewed nor endorsed by the Securities and Futures Commission of Hong Kong. You are advised to exercise caution in relation to this video. If you are in any doubt about any of the contents of this video. This material may not be reproduced, distributed or published without prior written permission from the Company. |