Education series

Q4 market outlook

Invesco

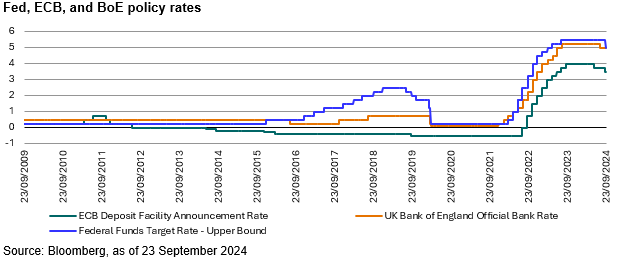

Inflation rates have gradually fallen towards central bank targets as efforts by global central banks to curb inflation bears fruit. Following rate cuts earlier this year by the European Central Bank (ECB) and the Bank of England (BoE), the US Federal Reserve has also recently announced a 50 basis point rate cut.

Historically, both equities and bonds tend to perform well following an initial Fed rate cut, as investors expect an easing cycle to spur economic recovery. Investors may, therefore, view the recent rate cut as an opportune moment to explore investment opportunities in global equities and fixed income assets.

However, in this easing cycle, we favour fixed income over equities, as the current economic environment may warrant a more defensive approach. Recent data reveals that economic growth is below the long-term average and the labor market is weak. The most significant risk facing the market in the next 12 months is a potential “hard landing” for the US economy.

As the US economy slows, other major economies have not picked up the growth mantle. For instance, recent Chinese economic data reflects only modest growth, while the outlook for the Eurozone recovery is weaker than anticipated, with the ECB recently downgrading its GDP growth forecasts for the next three years. Given these factors, we suggest that investors can consider bolstering their defensive positioning in Q4.

Equity market outlook

US equity valuations are currently above their historical averages, possibly already pricing in the anticipated easing cycle. As such, we do not foresee a significant market rally akin to those witnessed in previous easing cycles.

On sectors, we believe the bear market in technology stocks is likely to persist until the productivity gains brought by artificial intelligence are further proven.

Fixed income market outlook

We believe the macroeconomic environment now favours the fixed income market, driven by factors such as the Fed’s easing cycle, the increasing risk of a US recession and uncertainty surrounding the US presidential election.

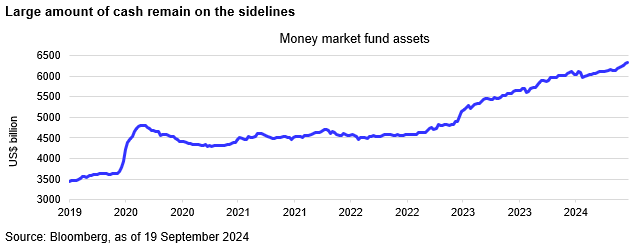

The high interest rate environment in recent years has led to substantial capital accumulation in money market funds.

As the Fed and the Bank of Canada cut rates, we may see a rotation into investment grade bonds as investors seek higher yields in fixed income. Currently, global investment grade bond yields stand at over 5%, a level that appears attractive from a historical perspective.

Bond yields typically decline as central banks cut rates. Therefore, investors seeking yields may wish to take the opportunity to lock in these compelling yields at current levels.

Key things to watch in Q4

The US presidential election is a key event to watch in Q4. The race between Kamala Harris and Donald Trump is proving to be a close one, with the outcome potentially impacting global asset prices. We believe that a Harris victory could reinvigorate investor confidence in North Asian and Taiwanese tech stocks, providing a moderate boost to Asian equity markets. Additionally, her comparatively moderate foreign policy stance may be generally viewed as favourable for Asian equities.

Conversely, a Trump victory would likely see a return to protectionist policies and increased tariffs. We believe that this scenario could benefit US small- and mid-cap stocks with a predominantly domestic focus. Furthermore, the potential for heightened geopolitical tensions arising from Trump’s tariff policies could increase the safe-haven appeal of gold.

Investment risks

|