Education series

2H2024 Equities & fixed income outlook: A rough sea needs a steady ship

J.P. Morgan

Moderating but still healthy global growth, coupled with more evidence of disinflationary momentum setting in, prompt certain central banks to begin their rate cut cycles in June.

However, in comparison to the aggressive rate hikes in the last few years, this will likely be a very gradual rate cut cycle for most of the global central banks, especially as we do not see strong foundations for a material easing cycle.

Given the Fed's reliance on incoming inflation data and other economic prints, this is like driving in the dark without street lights. Despite robust U.S. economic and inflation data in recent months, market still sees core inflation falling, and the Fed's next move to be a cut, not a hike. The overall rate cut cycle may be delayed, but not canceled. Uncertainty in the outcome rises significantly beyond that, and this is the key in market anxiety now. Recent correction in both stocks and bonds serves as a reminder of the importance of international diversification, as well as the need for different asset class in portfolio.

Asian markets present a good mixture of growth and dividend opportunities

The investment team stays positive on Asian equities on the back of the export recovery. Tech exporters, including South Korea and Taiwan, could continue to enjoy potential positive surprises in earnings outlooks. Improvement in Japan’s corporate governance continues to be rewarded by investors, while South Korea is looking to adopt similar reforms. China and Hong Kong present interesting value opportunities despite the cyclical and structural challenges facing the Chinese economy.

From a valuation perspective, Asian equities are trading at relatively attractive levels. From a 12-month forward price-to-earnings (P/E)perspective, most MSCI Asia Pacific ex-Japan regions (except for Korea, Taiwan, Thailand and India) are trading below 15-year average levels. From a price-to-book (P/B) perspective, most regions are trading more than 1 standard deviation^ below 15-year average levels. Historically, with MSCI APAC ex-Japan trailing price-to-book ratio trading at 1.6X, the next 12-month return for Asian equities tend to look positive.

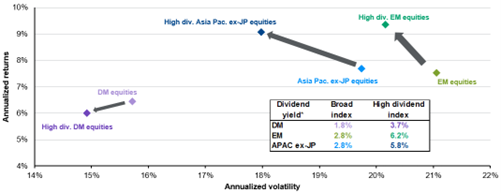

Dividend is crucial in the eye of Asian investors as dividend yield has contributed more than 60% of the cumulative total returns since 2000. In addition, MSCI Asia Pacific ex-Japan High Dividend index tends to provide a better risk-adjusted return relative to the broader MSCI Asia Pacific ex-Japan index, since there are usually a greater number of higher-quality companies with strong fundamentals to deliver dividends, as shown in Exhibit 1. Given the macroeconomic uncertainties and the likely decline in cash rates over the next 6 to 12 months, it will be increasingly essential to find the complementary pairing of fundamental resilience and stable dividends to preserve and enhance the total return of a portfolio.

Exhibit 1: Risk return profile of high dividend equities

Based on net total returns from Dec. 2000

^Standard deviation is a statistical measurement of the dispersion of a dataset relative to its mean. Source: FactSet, J.P. Morgan Asset Management. *Dividend yield reflects latest dividend yield. High div. means high dividend, DM means developed markets, Asia Pac. ex-JP means Asia Pacific ex-Japan. Past performance is not indicative of current or future results. Guide to the Markets – Asia. Data reflect most recently available as of 31/03/24.

Manage downside risks with fixed income

The delay in rate cuts by the Fed has resulted in higher government bond yields. In the short term, the total return on government bonds and high-quality fixed income may underperform cash. Nevertheless, long-term investors have two reasons to stay invested in fixed income.

First, as mentioned earlier, the rate cut cycle is delayed but not cancelled, implying that bond yields should eventually decline and boost total returns. Cash, on the other hand, would be ill-prepared for the eventual reinvestment risk.

Second, investors are currently focusing on a scenario of a soft landing or even no landing, accompanied by sticky inflation. However, while macroeconomic data remains robust, investors cannot ignore the possibility of a sharp deterioration in economic activity, even if this is unlikely. Government bonds and high-quality fixed income can help manage this risk.

With the divergence in rate cut expectations between market participants and the Fed narrowing, this could be a good opportunity to extend duration in developed market government bonds. Volatility in fixed income markets has also receded with softer inflation prints, allowing bonds to once again play a role as a traditional diversifier in portfolio construction.

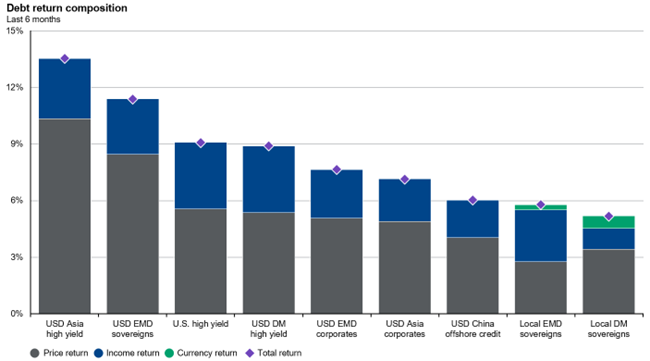

On U.S. corporate bonds, the investment team reiterates the importance of understanding the sources of potential return. Generally, lower risk-free rates and falling bond yields can provide reasonable returns for investors. Meanwhile, investment-grade and high yield corporate credit spreads could remain tight as fundamentals look sound. This implies a narrower scope for additional returns from spread compression.

Exhibit 2: Global fixed income return composition

Source: J.P. Morgan Economic Research, J.P. Morgan Asset Management. Based on J.P. Morgan Asia Credit High Yield Index (USD Asia high yield), J.P. Morgan CEMBI (USD emerging market debt (EMD) corporates), J.P. Morgan EMBI Global (USD EMD sovereigns), J.P. Morgan Asia Credit Corporates Index (USD Asia corporates), J.P. Morgan Asia Credit China Index (USD China offshore credit), J.P. Morgan Developed Market HY Index (USD DM high yield), J.P. Morgan Domestic High Yield Index (U.S. high yield), J.P. Morgan GBI-EM Global Diversified (Local EMD sovereigns), J.P. Morgan GBI-DM (Local DM sovereigns). Past performance is not a reliable indicator of current and future results.

Guide to the Markets – Asia. Data reflect most recently available as of 31/03/24.

In conclusion, we anticipate that the current wave of volatility from evolving rate cut expectations will eventually subside, and investors should look ahead to position their portfolios accordingly. We believe a well-diversified portfolio comprising of both stocks and fixed income assets remains key to generating returns that align with long-term investment objectives, even though cash may appear attractive during times of volatility.

| Important Information Source: J.P. Morgan Asset Management, 30.06.2024. Diversification does not guarantee positive returns or eliminate risk of loss. Cash is based on Bloomberg Short-term Treasury Total Return Index The Market Insights program provides comprehensive data and commentary on global markets without reference to products. Designed as a tool to help clients understand the markets and support investment decision-making, the program explores the implications of current economic data and changing market conditions. For the purposes of MiFID II, the JPM Market Insights and Portfolio Insights programs are marketing communications and are not in scope for any MiFID II / MiFIR requirements specifically related to investment research. Furthermore, the J.P. Morgan Asset Management Market Insights and Portfolio Insights programs, as non-independent research, have not been prepared in accordance with legal requirements designed to promote the independence of investment research, nor are they subject to any prohibition on dealing ahead of the dissemination of investment research. This document is a general communication being provided for informational purposes only. It is educational in nature and not designed to be taken as advice or a recommendation for any specific investment product, strategy, plan feature or other purpose in any jurisdiction, nor is it a commitment from J.P. Morgan Asset Management or any of its subsidiaries to participate in any of the transactions mentioned herein. Any examples used are generic, hypothetical and for illustration purposes only. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any securities or products. In addition, users should make an independent assessment of the legal, regulatory, tax, credit, and accounting implications and determine, together with their own financial professional, if any investment mentioned herein is believed to be appropriate to their personal goals. Investors should ensure that they obtain all available relevant information before making any investment. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to change without prior notice. All information presented herein is considered to be accurate at the time of production, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. It should be noted that investment involves risks, the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Both past performance and yields are not reliable indicators of current and future results. J.P. Morgan Asset Management is the brand for the asset management business of JPMorgan Chase & Co. and its affiliates worldwide. To the extent permitted by applicable law, we may record telephone calls and monitor electronic communications to comply with our legal and regulatory obligations and internal policies. Personal data will be collected, stored and processed by J.P. Morgan Asset Management in accordance with our privacy policies at https://am.jpmorgan.com/global/privacy. This communication is issued by the following entities: In the United States, by J.P. Morgan Investment Management Inc. or J.P. Morgan Alternative Asset Management, Inc., both regulated by the Securities and Exchange Commission; in Latin America, for intended recipients’ use only, by local J.P. Morgan entities, as the case may be. In Canada, for institutional clients’ use only, by JPMorgan Asset Management (Canada) Inc., which is a registered Portfolio Manager and Exempt Market Dealer in all Canadian provinces and territories except the Yukon and is also registered as an Investment Fund Manager in British Columbia, Ontario, Quebec and Newfoundland and Labrador. In the United Kingdom, by JPMorgan Asset Management (UK) Limited, which is authorized and regulated by the Financial Conduct Authority; in other European jurisdictions, by JPMorgan Asset Management (Europe) S.à r.l. In Asia Pacific (“APAC”), by the following issuing entities and in the respective jurisdictions in which they are primarily regulated: JPMorgan Asset Management (Asia Pacific) Limited, or JPMorgan Funds (Asia) Limited, or JPMorgan Asset Management Real Assets (Asia) Limited, each of which is regulated by the Securities and Futures Commission of Hong Kong; JPMorgan Asset Management (Singapore) Limited (Co. Reg. No. 197601586K), this advertisement or publication has not been reviewed by the Monetary Authority of Singapore; JPMorgan Asset Management (Taiwan) Limited; JPMorgan Asset Management (Japan) Limited, which is a member of the Investment Trusts Association, Japan, the Japan Investment Advisers Association, Type II Financial Instruments Firms Association and the Japan Securities Dealers Association and is regulated by the Financial Services Agency (registration number “Kanto Local Finance Bureau (Financial Instruments Firm) No. 330”); in Australia, to wholesale clients only as defined in section 761A and 761G of the Corporations Act 2001 (Commonwealth), by JPMorgan Asset Management (Australia) Limited (ABN 55143832080) (AFSL 376919). For all other markets in APAC, to intended recipients only. For U.S. only: If you are a person with a disability and need additional support in viewing the material, please call us at 1-800-343-1113 for assistance. Copyright 2024 JPMorgan Chase & Co. All rights reserved. |