Market watch

2024 Global Economic Outlook

Issue date: 2024-04-22

Schroders

Part 1: Markets Review

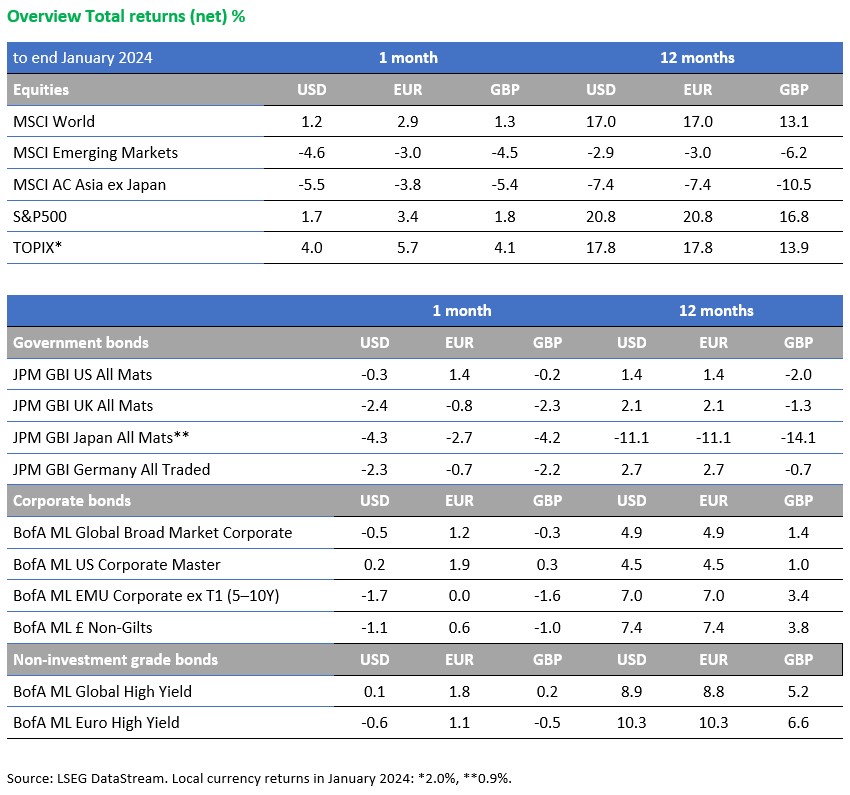

Stock markets were mixed in January with developed market shares advancing while emerging markets saw negative returns. There were signals from major central banks that interest rate cuts may not be forthcoming as soon as had been hoped.

In bond markets, government bond yields rose (meaning prices fell). Oil prices moved up amid ongoing conflict in the Middle East and disruption to shipping.

Part 2: Global Economic Outlook

The balance of risks is still skewed in a stagflationary direction.

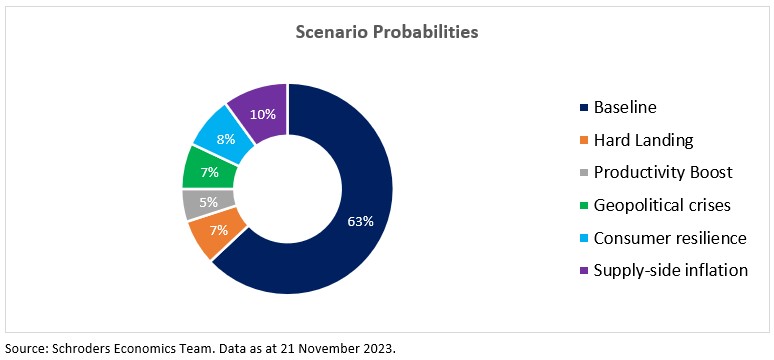

As shown by recent resilient spending data, there is a risk that monetary policy has become less effective and that consumption will remain buoyant, preventing a smooth decline in inflation and even forcing interest rates higher. Our analysis suggests that while this consumer resilience scenario could add a cumulative 1.3 percentage points (pp) of additional growth to our global forecast, it would also add 1.3 pp to inflation and delay reductions in interest rates. Indeed, resurgent demand and inflation could force a further tightening of monetary policy. At the same time, though, there is also a clear risk that the long and variable lags in policy transmission come to the fore more quickly than anticipated, leading to a hard landing in the global economy.

However, there also remains a lot of uncertainty about the supply side of the global economy. Euphoria about new technologies such as artificial intelligence (AI) could translate more quickly into an investment boom that results in a productivity boost that supports a softer landing than we assume in our baseline forecast. Equally, though, there is a risk that negative supply shocks move the global economy in a more stagflationary direction as tracked by a supply side inflation scenario. Recent signs of moderation in labour markets such as the US could prove to be a false dawn and persistently elevated wage growth may cause higher rates of inflation to become ingrained.

Finally, geopolitical crises could disrupt commodity supplies – particularly of oil – and hinder international trade and investment, and lead to resurgent inflation. Both scenarios would leave central banks in advanced economies with little or no room to cut interest rates. Our long-running supply side inflation scenario continues to be assigned a relatively high probability of 10%. This, along with the 7% assigned to the geopolitical crises scenario, means that stagflationary outcomes remain the biggest risk to our baseline forecast.

Global GDP growth is expected to ease from 2.7% in 2023 to 2.2% in both 2024 and 2025. Among advanced economies, growth is forecast to fall from 1.6% in 2023 to 1.0% in 2024 before ticking up to 1.1% in 2025.

For the time being, the US economy continues to defy gravity, but we do expect growth to slow as higher interest rates gradually feed through to activity. We also expect the eurozone to have already fallen into recession before the end of 2023, with the UK economy probably following suit in the first half of 2024.Meanwhile, emerging-market growth is forecast to slow from 4.2% in 2023 to 3.9% in 2024 and 3.8% in 2025. In China, the authorities have been in loosening mode for some time and further easing is likely as Beijing attempts to manage the end of its housing-led economic model.

We expect global consumer price index (CPI) inflation to moderate from 4.4% in 2023 to 2.9% in 2024 before edging up to 3.0% in 2025. Even so, disinflation up until this point has in large part been due to fading commodity price effects rather than a significant easing in underlying, core price pressures and so the hard yards in getting inflation down to target are still to come.

We expect that the European Central Bank (ECB) will be the first major developed-market central bank to start cutting rates. We forecast 150 basis points (bp) of rate cuts, starting in Q1 2024, taking the deposit rate down to 2.5% by the middle of 2025. Following not far behind should be the Bank of England (BoE), for which we have pencilled 125bp of easing to 4% by mid-2025. By contrast, we think the Fed will be the last to cut rates. We have pushed back our expectations for the Fed pivot and now expect a first cut in September 2024, with rates eventually falling by 200bp to 3.5% in 2025.

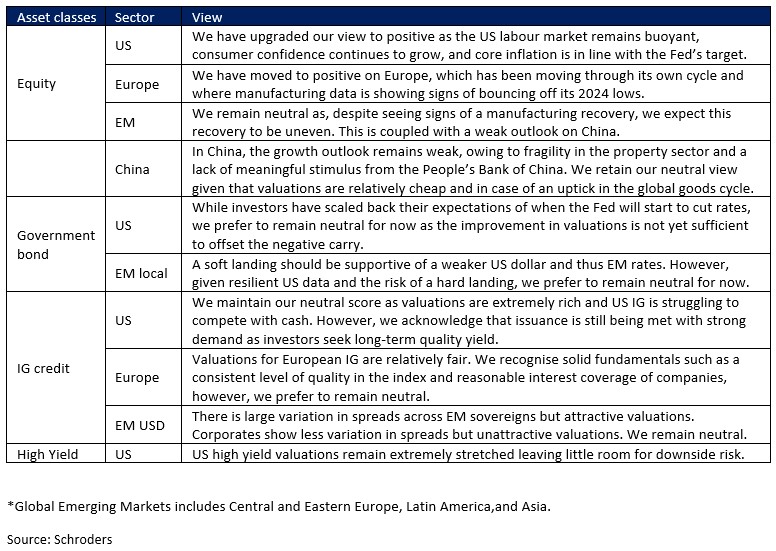

Part 3: Multi-Asset View

Important Information The contents of this document may not be reproduced or distributed in any manner without prior permission. This document is intended to be for information purposes only and it is not intended as promotional material in any respect nor is it to be construed as any solicitation and offering to buy or sell any investment products. The views and opinions contained herein are those of the author(s), and do not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. The material is not intended to provide, and should not be relied on for investment advice or recommendation. Any security(ies) mentioned above is for illustrative purpose only, not a recommendation to invest or divest. Opinions stated are valid as of the date of this document and are subject to change without notice. Information herein and information from third party are believed to be reliable, but Schroder Investment Management (Hong Kong) Limited does not warrant its completeness or accuracy. Investment involves risks. Past performance and any forecasts are not necessarily a guide to future or likely performance. You should remember that the value of investments can go down as well as up and is not guaranteed. You may not get back the full amount invested. Derivatives carry a high degree of risk. Exchange rate changes may cause the value of the overseas investments to rise or fall. If investment returns are not denominated in HKD/USD, US/HK dollar-based investors are exposed to exchange rate fluctuations. Please refer to the relevant offering document including the risk factors for further details. This material has not been reviewed by the SFC. Issued by Schroder Investment Management (Hong Kong) Limited. |