Market watch

Navigating a challenging environment

Issue date: 2022-06-30

Barings

From capital structure seniority and high historical recovery rates, to lower interest rate sensitivity and compelling yields, global senior secured bonds offer a number of potential advantages.

The global senior secured bond market is a sizable subcomponent of the broader global high yield bond asset class and, as the name indicates, comprises bonds that are senior and secured in the capital structure. Senior secured bonds reside at the top of a company’s capital structure, ranking first in line for repayment in priority over other liabilities and shareholder interests. They also benefit from security interests in various firm assets, which can include tangible assets - such as property, plant and equipment, inventory and contractual claims - as well as intangible items like software and trademarks. Ultimately, this means that if a company defaults on its debt obligations, senior secured bondholders are first in line for any repayments, in priority over other creditors, and also stand to benefit from their control (via the security interests) in the assets that are critical for running the business.

As a result, senior secured bonds have historically offered higher recovery rates than unsecured bonds. For example, from 1987 to 2021, the average recovery rate for defaulted senior secured bonds was 61.5%, compared to 47.4% for senior unsecured bonds and 27.9% for subordinated debt1. The success of the senior secured bond market has been such that over the past five years it has increased in size by roughly 70% to over US$500 billion, equivalent to about one third of the global high yield bond market2. This is a broad, deep and well-diversified market that provides ample options for an active global high yield manager, with a rich opportunity set to generate sustainable alpha.

It has been an extremely challenging and volatile period for most financial markets this year, driven by elevated inflationary pressures, hawkish central bank activity with expectations of rising interest rates and tightening financial conditions, geopolitical tensions with Russia’s invasion of Ukraine, and the ongoing disruption from COVID-19, particularly in key regions such as China. Like other segments of the global fixed income markets, senior secured bonds have not been immune from the pressure stemming from the rise in government bond yields around the world.

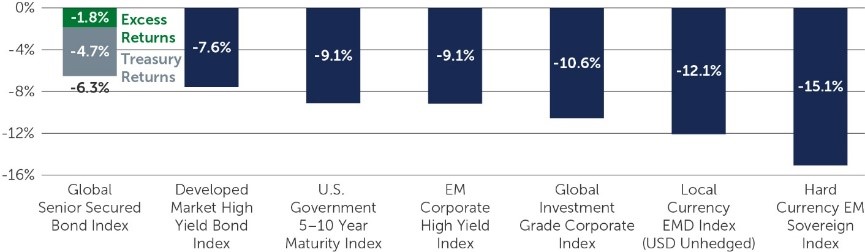

Of note, however, senior secured bonds have outperformed most other global bond markets year to date. This is largely due to the asset class’ shorter duration profile (a measure of interest rate sensitivity) and high coupon levels, which have created an attractive alternative to the higher-quality, more interest rate sensitive segments of fixed income (Figure 1).

Figure 1: Year-to-Date Returns Across Fixed Income Asset Classes

Over the past decade, we have observed a similar trend, with senior secured bonds demonstrating lower volatility and downside market capture versus broader credit markets in periods of elevated market stress, such as during the 2015 commodity crisis and the market sell-off in the fourth quarter of 2018.

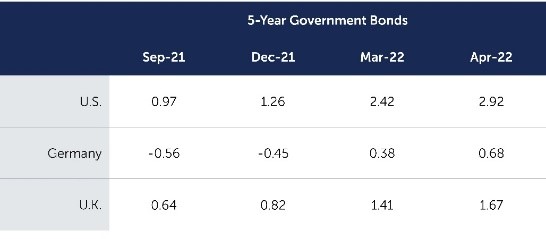

So far, 2022 has proven to be a highly unusual environment for global credit markets. Over the last decade, most periods of negative returns in credit markets could be attributed to a combination of deteriorating fundamentals and increasing risk aversion, which drove credit spreads wider. This time around, credit fundamentals have remained strong - but as developed markets are being ravaged by inflation for the first time in almost 40 years, we have seen historically significant increases in government bond yields, which have driven prices lower across all segments of fixed income. In fact, the rise in government bond yields during the first four months of the year was so sharp (Figure 2) and severe that it could not be offset by interest income. Following the U.S. Federal Reserve’s (Fed) decision in early May to raise interest rates by 50 basis points (bps), the market was still pricing in an additional 2.2% of rate hikes, or a policy rate of over 3%, over the next one year.

Against this backdrop, it is worth noting that senior secured bonds tend to have lower interest rate sensitivity - as measured by modified duration to worst - than other asset classes. For example, senior secured bonds currently have a duration of 4.0 years, compared to a duration of 4.4 years for the broader high yield market and 6.6 years for investment grade credit3.

Figure 2: Government Bond Yields Rose Sharply Through April

Company Fundamentals Remain Resilient

While credit spreads (a measure of default risk) within the senior secured bond market have widened on a year-to-date basis, driven in part by heightened macroeconomic uncertainty, the widening has occurred against a backdrop of relatively resilient credit fundamentals. Company financials have improved considerably following the initial COVID-19 induced shock in 2020, with leverage levels and debt service costs decreasing materially. Further, given the record amounts of new bond issuance in the senior secured bond space and across broader credit markets over the past two years, issuers have been able to raise ample liquidity buffers and push out debt maturity walls. As a result, default rates remain muted and near-term solvency risks look to be relatively well-contained.

While inflationary pressures continue to build, companies have generally been able to pass on increased input costs to their end customers. This is partly due to the strong financial position of developed market households amid high savings rates through the pandemic, as well as rising wages in response to tight labor markets. Pent up consumer demand across specific market segments is another contributor, and has remained robust as economies emerge from COVID-related lockdowns and restrictions. Even in some of the sectors hit hardest by the pandemic, a number of companies look well-positioned to benefit from the ongoing reopening across developed markets; travel and leisure companies, for instance, have been performing relatively well in recent periods.

Significant Re-Pricing Has Created Select Opportunities

As a result of the sharp move higher in bond yields, driven largely by rising government bond yields but also, more recently, from widening credit spreads, the senior secured bond market is trading at a considerable discount to par. At the start of the year, the average bond in the market was trading at a premium price - around 101.4 - compared to the face value of 100 per bond. Today, because of the increase in yields, we have seen a significant decline, to a discounted price of 90.94.

Following these price declines, the yield-to-worst for the senior secured bond market has increased by over 3% year to date, and is now approaching 8%. The combination of higher yields with materially discounted bond prices is an ideal environment in which to drive attractive total returns. Indeed, the overall price dislocations have created compelling opportunities given the relatively higher yield levels on offer, as well as the potential total return opportunities for securities that will eventually migrate back toward par value over time.

To put valuations into some context, current credit spreads for senior secured bonds are broadly in line with levels observed during the fourth quarter of 2018, a period characterized by rising concerns that Fed policies could result in tightening financial conditions. What is different - and more beneficial - today, however, is that the price of the average bond is over four points lower than the comparable period at the end of 2018. This is against a backdrop of relatively sound credit fundamentals and record low default levels, which should offer some added comfort in a slowing-growth environment.

Looking across a longer time horizon, since the Global Financial Crisis there have been three distinct periods where yield-to-worst levels for the senior secured bond market have exceeded 8%. In all of these periods, the 12-month forward returns from the time yields first exceed 8% levels has been quite strong.

Key Takeaways

As we look across the markets today, and given some of the significant re-pricing that we have observed thus far in 20225, we believe senior secured bonds offer an interesting investment opportunity for a number of reasons:

- Relative to most fixed income markets, senior secured bonds have a relatively lower interest rate sensitivity profile

- Despite corporate fundamentals remaining relatively resilient, senior secured bond yields are approaching 8% with bonds trading at around 10% discount levels, offering attractive return prospects

- Seniority in the capital structure may be preferred in an environment of heightened uncertainty and slowing growth

There is no shortage of risk factors to watch going forward. The long-term impacts of the Russia-Ukraine war are impossible to quantify at this stage, and have created considerable levels of uncertainty across markets. Further, aggressive monetary policy tightening and elevated inflationary pressures may continue to weigh on market sentiment and drive market volatility.

But it’s important to note that periods of volatility can - and often do - result in opportunities for active, bottom-up managers to generate alpha. This has been the case through multiple market events, from the sovereign debt crisis, to the commodity crisis, to the COVID-19 selloff. However, through these ups and downs, vigilance is key. If the past is any indication, a steadfast focus on fundamentals and bottom-up, credit-by-credit analysis can help identify issuers with the potential to thrive beyond today’s events.

1 Source: Moody’s Investors Services Annual Default Study. As of February 8, 2022.

2 Source: ICE BofA BB-B Global High Yield Secured Bond Index, ICE BofA Non-Financial Developed Markets High Yield Constrained Index. As of April 30, 2022.

3 Source: ICE BofA Non-Financial Developed Markets High Yield Constrained Index, ICE BofA Global Corporate Index. As of April 30, 2022.

4 Source: ICE BofA BB-B Global High Yield Secured Bond Index. As of May 13, 2022.

5 As of May 2022.

Important information The document is for informational purposes only and is not an offer or solicitation for the purchase or sale of any financial instrument or service. The material herein was prepared without any consideration of the investment objectives, financial situation or particular needs of anyone who may receive it. This document is not, and must not be treated as, investment advice, investment recommendations, or investment research. In making an investment decision, prospective investors must rely on their own examination of the merits and risks involved and before making any investment decision, it is recommended that prospective investors seek independent investment, legal, tax, accounting or other professional advice as appropriate. Unless otherwise mentioned, the views contained in this document are those of Barings. These views are made in good faith in relation to the facts known at the time of preparation and are subject to change without notice. Parts of this document may be based on information received from sources we believe to be reliable. Although every effort is taken to ensure that the information contained in this document is accurate, Barings makes no representation or warranty, express or implied, regarding the accuracy, completeness or adequacy of the information. Any forecasts in this document are based upon Barings opinion of the market at the date of preparation and are subject to change without notice, dependent upon many factors. Any prediction, projection or forecast is not necessarily indicative of the future or likely performance. Any investment results, portfolio compositions and/or examples set forth in this document are provided for illustrative purposes only and are not indicative of any future investment results, future portfolio composition or investments. The composition, size of, and risks associated with an investment may differ substantially from any examples set forth in this document. No representation is made that an investment will be profitable or will not incur losses. Where appropriate, changes in the currency exchange rates may affect the value of investments. Investment involves risks. Past performance is not a guide to future performance. Investors should not only base on this document alone to make investment decision. |