Market watch

Capture the sustainable growth potential in Asia

Issue date: 2022-09-30

Fidelity

Persistently rising prices, against the backdrop of war in Ukraine, have pushed the US Federal Reserve (Fed) and other central banks to prioritise managing inflation above engineering a soft landing, prompting a “global reset”. We believe Asia stands in a relatively strong position amid this widescale disruption.

Asian equity markets offer diversified opportunities

Many Asian markets are geographically and economically removed from the conflict in Europe. They’re also backed by a stronger policy arsenal, with China in particular continuing to loosen while most other economies are forced to tighten. Nevertheless, the region presents its own set of risks brought on by geopolitical tensions, ongoing energy and food crises, and volatile consumption habits.

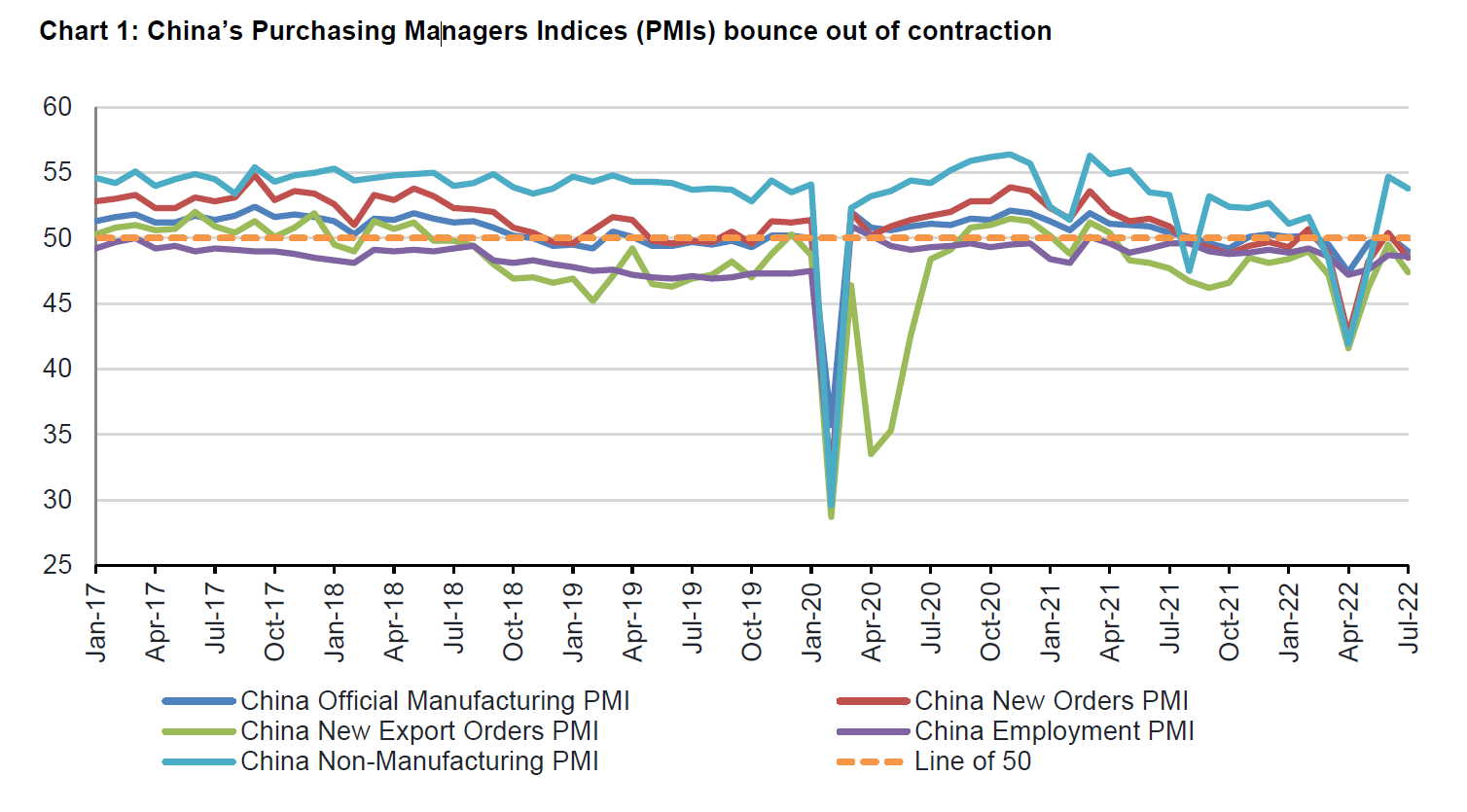

China has had a challenging first half of 2022. A supportive policy backdrop should have proven a boost to the Chinese economy. However, its impact has so far been offset by the country’s Zero-Covid Policy (ZCP). Lockdowns across several cities, most notably Beijing and Shanghai, led to a short but sharp economic downturn, especially during April and May.

As China emerges from its spring lockdowns, tentative signs of rebound activity are encouraging. The hope is that loose monetary and fiscal policy can now begin to have their desired effect. We are positive on both China offshore and onshore equities, given positive drivers across fundamentals, valuations and technicals, across three month and 12-month horizons.

Nevertheless, any optimism sprouting from China’s re-emergence is tinged with uncertainty. We are yet to see how the Chinese consumer will bounce back with ZCP lockdowns still fresh in the mind, nor the impact supportive policy will have. Unemployment too is on the rise, particularly among the youth, with nearly 20 per cent of 18 to 24-year-olds out of work. Moreover, the prospect of a Covid resurgence casts a shadow. Any further lockdowns could pose another major blow to its economy.

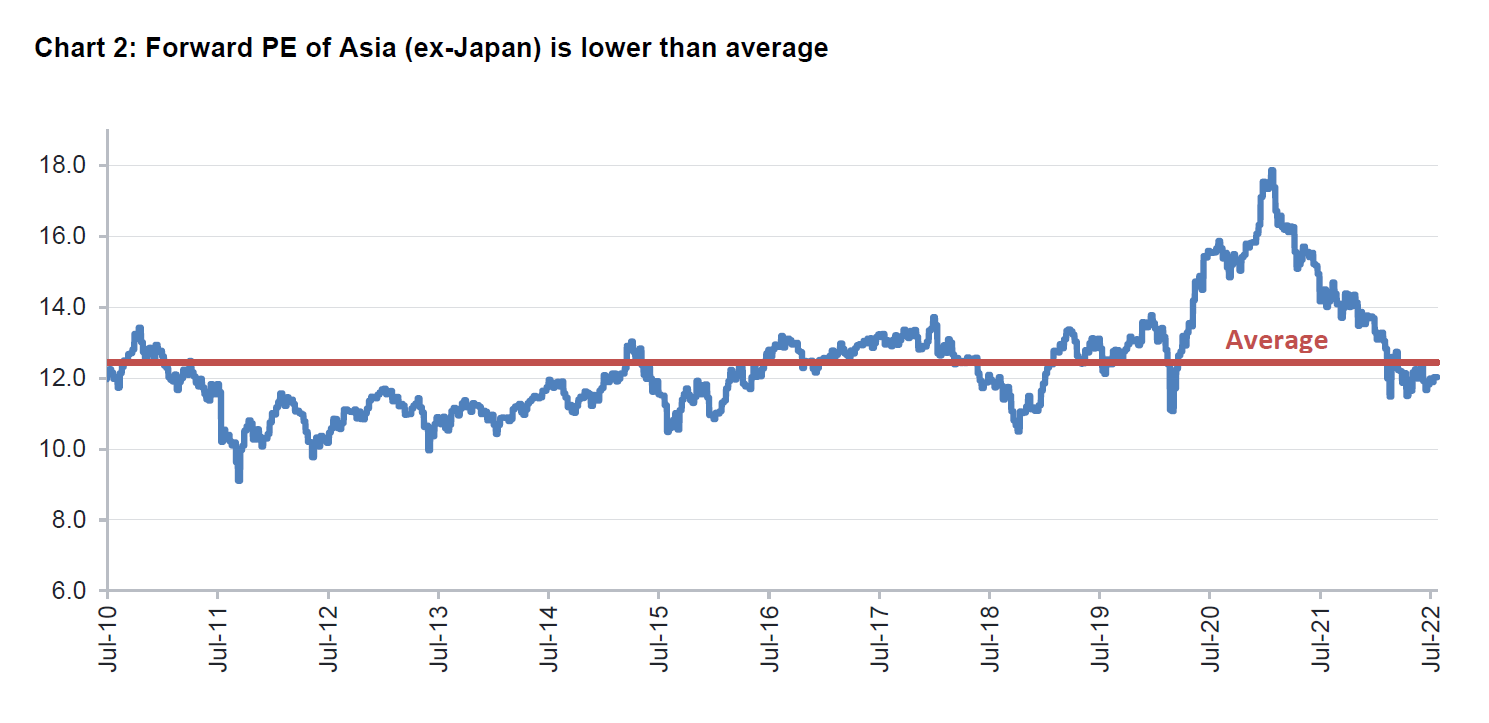

As Asia opens its doors too, opportunities have begun to present themselves. The region consists of a diverse group of economies, each with its strengths and weaknesses. This lack of uniformity has a mitigating effect on external shocks, be it inflation or the Russian invasion of Ukraine. Also, valuations of Asian equities are attractive, especially when compared to developed markets. As a result, Asia offers investors a range of long-term growth potential and diversification opportunities.

Why ESG matters for investing in Asia

For investors seeking financial returns in Asia, ESG investing is essential for three main reasons:

• ESG issues are changing the business landscape

• Corporate governance remains a critical risk

• ESG disclosure remains uneven

It is vital to understand how ESG is changing the slope of the playing field across various industries and sectors in Asia. For example, the global push for decarbonisation is creating winners and losers, with new technology and businesses taking over those being pushed closer to obsolescence. In the electric-vehicle battery segment, safety concerns have seen certain manufacturers gain favour over others, even if their products may be inferior in terms of driving range. Meanwhile, heightened regulatory scrutiny and consumer pressure surrounding employee welfare combine to increase wage costs for platforms that host gig workers. Tightening data privacy laws makes targeted advertising less effective for social media companies, lowering their revenue potential.

Next, corporate governance is a crucial investment risk in Asia because many companies have structures where insiders have unchecked power. At the same time, their quality and integrity can determine an investment’s success or failure. Hence, it is vital to analyse a company’s decision makers.

Third, despite continuing improvements in ESG disclosure in Asia, it remains uneven. This bestows an advantage on investors who can obtain real ESG insights through primary research and direct conversations with management. While third-party ratings are also available, their need to cover the entire market width leaves them wanting in terms of depth. Their inadequacies are due to their reliance on company disclosure, which tends to be backward looking, while there are weaknesses in their methodology.

Conclusion

As we move through the second half of 2022, we see central banks striving to rein in inflation, even if it means trading off some economic growth. Financial markets have already reacted poorly to these uncertainties, and further volatility is expected. To better navigate uncertainty, investors can consider investing in high quality Asian stocks with good ESG to diversify their risks.

IMPORTANT INFORMATION FIL Limited and its subsidiaries are commonly referred to as Fidelity or Fidelity International. Fidelity, Fidelity International, the Fidelity International logo and F symbol are trademarks of FIL Limited. Any person considering an investment should seek independent advice. Investment involves risks. This material contains general information only. It is not an invitation to subscribe for shares in a fund nor is it to be construed as an offer to buy or sell any financial instruments. The information contained in this material is only accurate on the date such information is published on this material. Opinions or forecasts contained herein are subject to change without prior notice. Reference to specific securities mentioned within this material (if any) is for illustrative purpose only and should not be construed as a recommendation to the investor to buy or sell the same. The material is issued by FIL Investment Management (Hong Kong) Limited and it has not been reviewed by the Securities and Futures Commission (“SFC”). |