Market watch

Innovative systematic equity income solution

Issue date: 2023-03-31

Blackrock

Faced with unprecedented market conditions, investors need to think differently about how they are investing for income.

1. Innovative income solution powered by signals and data driven insights

The strategy uses cutting edge technology and processes to build a diversified portfolio of dividend paying global equities and identify stocks with the potential to deliver high income at lower risks.

2. The other side of volatility is higher income potential

The solution may take advantage of today’s volatile market environment to generate higher income premiums in its covered calls strategy.

Heightened market movements also create vast amount of data. Analysis on these real time data enables BlackRock to potentially cut through the noise to increase accuracy and forecasting power of stock and income return, and to capture potential capital growth when the global economy recovers.

Furthermore, to actively manage volatility, the strategy applies effective risk controls with the aim to achieve market upside while minimizing drawdowns.

3. Highly tactical model that focuses on the future

The new market regime requires agility and frequent tactical view changes based on current market developments, and less reliance on risk models calibrated to history. To reflect these movements timely, the strategy is rebalanced on a weekly basis, incorporating “real time” data into the signals that help the strategy stay nimble to navigate a rapidly changing market.

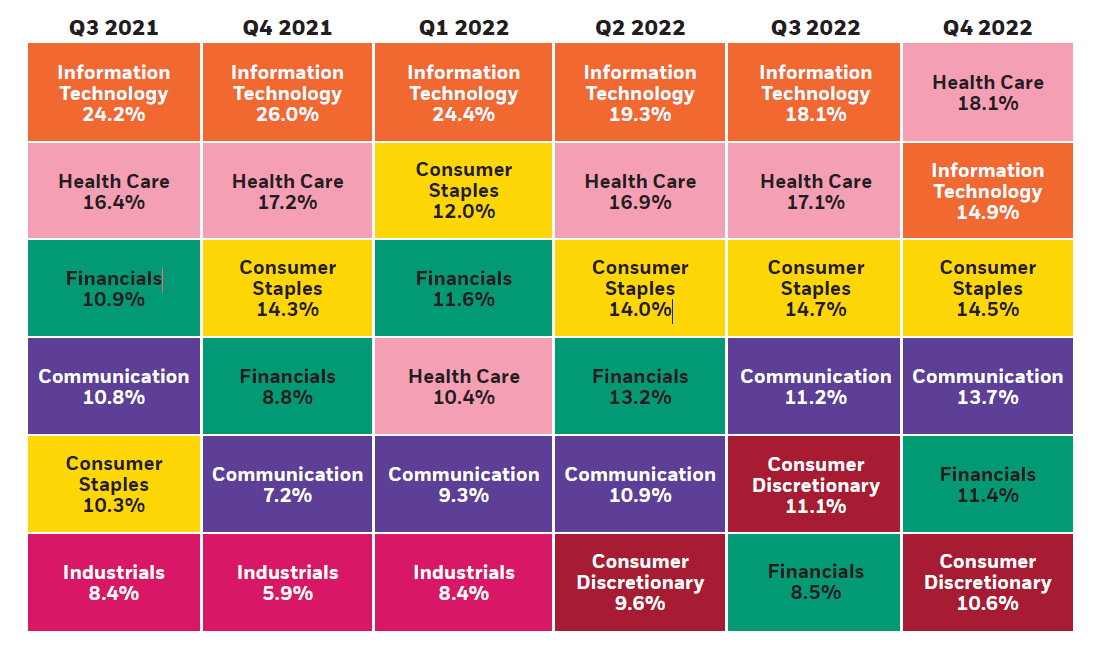

Changes in the top sectors of the strategy1

Decoding the Markets using a Systematic Approach

After a year of extreme macroeconomic events, the outlook for inflation has started to improve. So where’s the market heading next as we are moving into Q2 2023? Alternative data reveals insight on the current economic backdrop and what it means for investors. Below are some examples of the data BlackRock leverages on.

Inflation Data

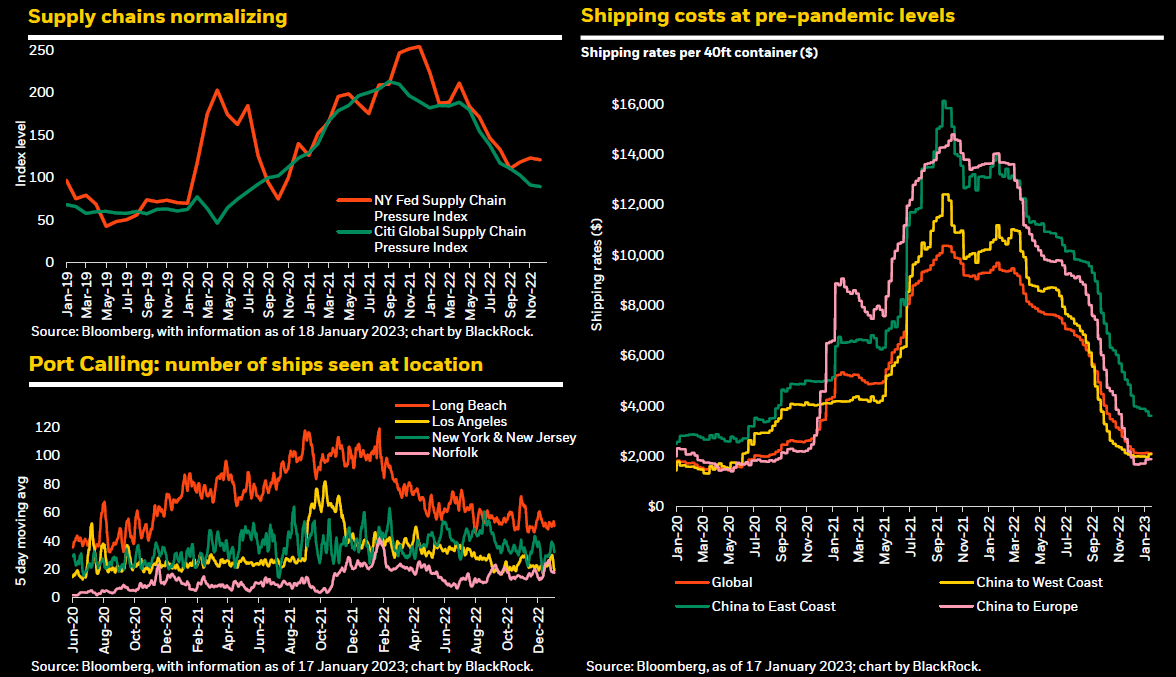

- Despite negative perceptions, the inflation outlook has turned more benign, particularly in the US

- Recent trends in stress indicators and shipping routes show they are now operating at pre-pandemic levels

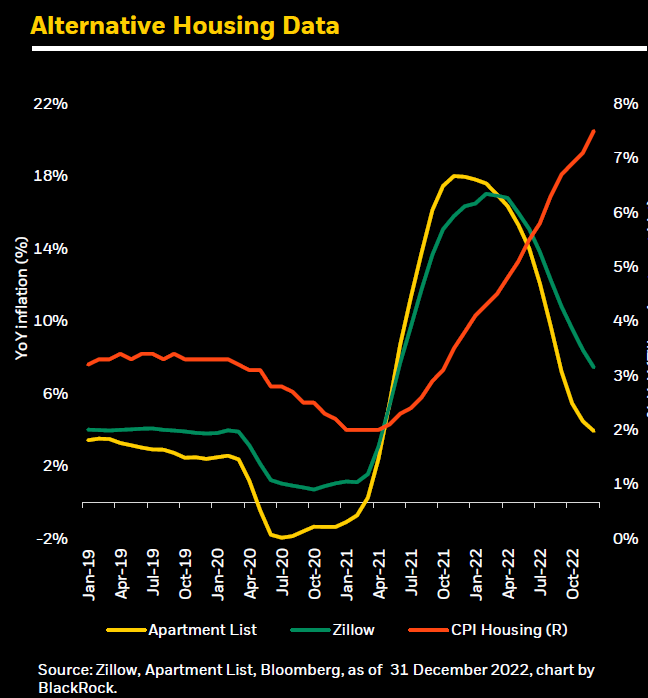

Housing Markets Data

- Alternative indicators of US housing markets already show an important decline of shelter related inflationary pressures

- Housing starts also showing signs of the market slowing down materially

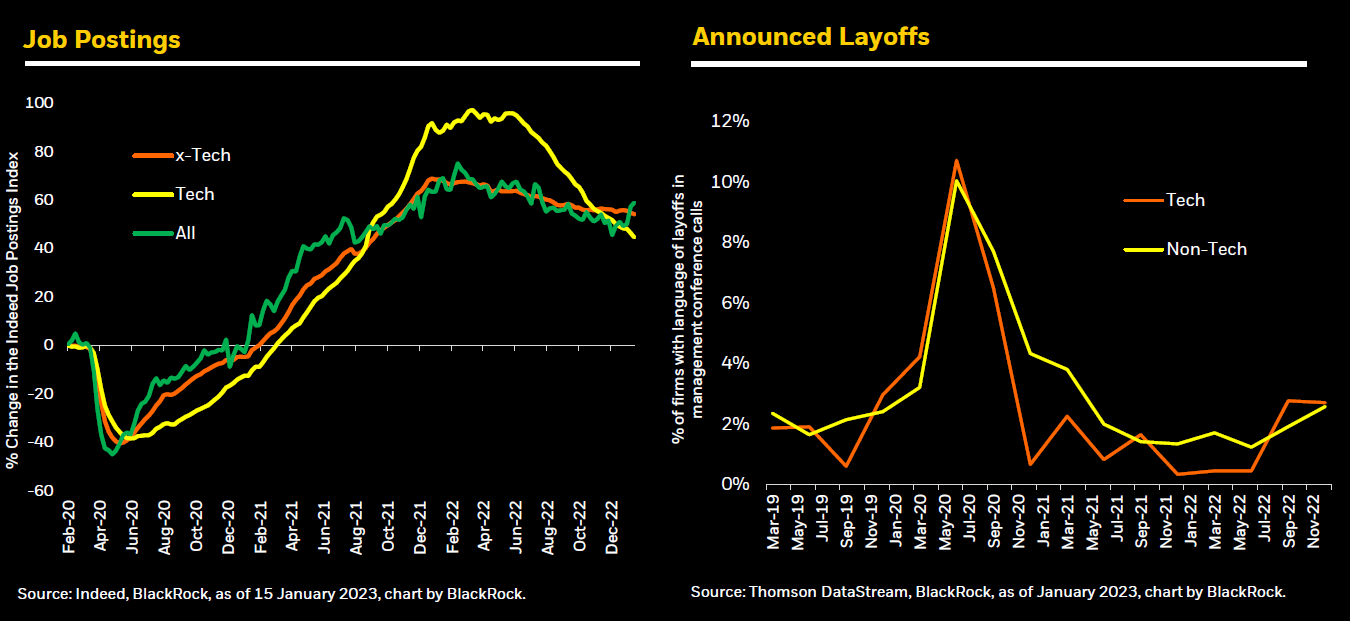

Labor Markets Data

- Despite recession talk, labor markets may experience a growth-friendly adjustment

- Job postings have started to moderate, especially in the tech sector

- Announced layoffs shows a relatively moderate amount of job reductions

1Source: BlackRock, as of 31 December 2022. Allocations are subject to change. Due to rounding, the total may not be equal to 100%.

Important Information In Hong Kong, this material is issued by BlackRock Asset Management North Asia Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong. No part of this material may be reproduced, stored in retrieval system or transmitted in any form or by any means, electronic, mechanical, recording or distributed without the prior written consent of BlackRock. © 2023 BlackRock, Inc. All Rights Reserved. BLACKROCK is a registered trademark of BlackRock, Inc. or its subsidiaries in the United States and elsewhere. All other trademarks are those of their respective owners. |