Education series

Start regular investing early - As twice as much for half as long may not be the answer

People often think that delaying starting a regular investment plan by a couple of years won’t matter that much and assume that they can ‘catch-up’ by investing a higher monthly amount later in life. However the effect of delaying can be greater than you think.

It will be easy to catch up later on- won’t it?

It is all too easy to put off planning early particularly if you are in the early stages of your working life or you have no financial goal in mind. It’s human nature. Especially if you expect you will earn more as time goes on, you might think that it makes sense to wait and invest more later.

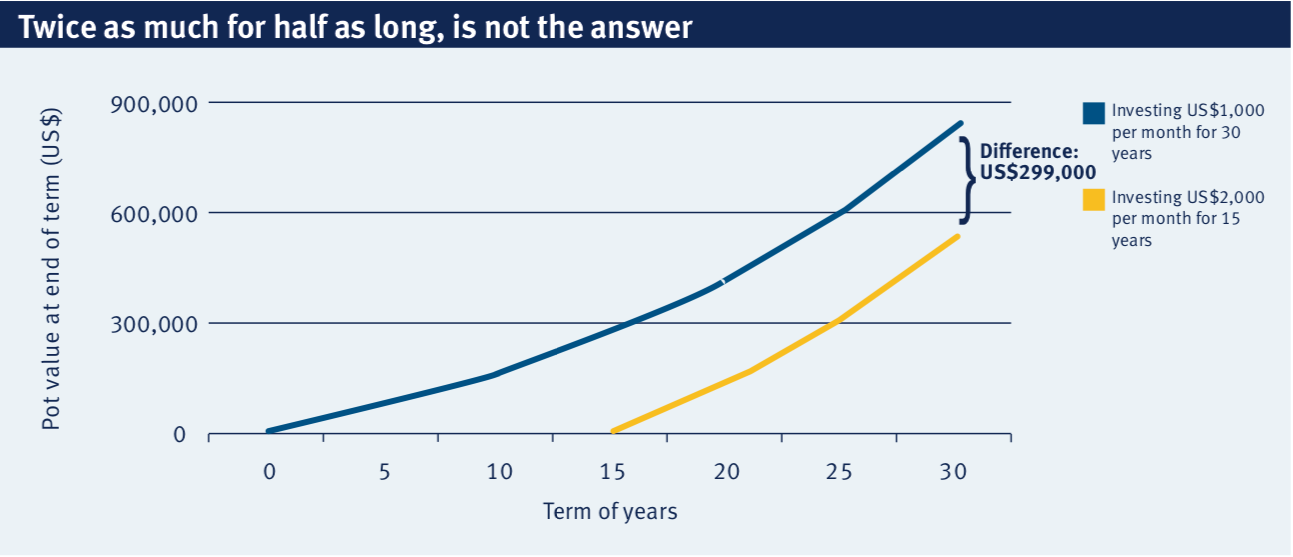

However, when you look at the example below you’ll see how big an impact delaying could have. You might be forgiven for thinking that investing twice as much on a monthly basis for half the time will achieve the same goal. That’s not the case at all.

Start now and see the benefits

If you invest US$1,000 each month into an investment plan for over 30 years you might end up with a pot of around US$835,000*.

However if you decide to leave it for 15 years and then put in twice as much, so US$2,000 each month, your pot might only be worth around US$536,000* i.e. the end result is almost 1/3 less than if you had started earlier, even though you have put in the same total amount.

*Important notes

Pot values quoted assume an annual growth rate of 5% over the periods indicated. These figures are indicative only and not based on an actual investment. There is no guarantee of the annual growth rate. You will be subject to investment and market risks.

Cost of delay

So remember, the longer you delay, the more money you will need to put in to achieve a particular lump sum and investing twice as much for half the time is not the answer.

It may be stating the obvious, but when it comes to long-term investing, the sooner you start, the greater the opportunity to build up a bigger fund pot for your future.

What might not be so obvious is just how big that effect can be.

Investing in an investment-linked assurance scheme may be one of the options for you to reach your financial goal.

Ask your financial adviser for other examples of the impact of delaying starting your plans or for our ‘Your guide to regular investing’ brochure.

Now’s the time to start planning. Now’s the time to talk to Heng An Standard Life (Asia). Ask your financial adviser for details.

“I always thought I’d be able to catch-up by investing more later in life when I was earning more. I now realise I should’ve started years ago”

It’s easy to put off starting planning. But remember, investing twice as much for half as long may not be the answer.

Find out more.

www.standardlife.hk

Disclaimer: The above information is for reference only and should not be construed as legal, tax and investment advice. You should seek professional advice regarding your tax circumstances and the types of investment that are suitable for you. Investing in investment-linked assurance scheme involves investment risks. Past performance is not indicative of future performance.