Education series

Direct fund approach vs mirror fund approach

Heng An Standard Life (Asia) offers a wide range of investment choices in the platform. All of the investment choices are using the Direct Fund approach to increase investment transparency.

Investment approach

Most issuers of the investment-linked assurance scheme provide many investment choices for their policyholders and may adopt one of the following approaches when managing their investment choices.

Direct Fund Approach or Mirror Fund Approach

Generally, the investment choices, no matter they use Direct Fund approach or Mirror Fund approach, are linked to the underlying funds managed by reputable investment managers. You will benefit from the investment expertise of investment managers to capture market opportunities. However, you should understand the two approaches and select the one that is suitable for you.

Comparison of Direct Fund Approach and Mirror Fund Approach

| Direct Fund Approach | Mirror Fund Approach | |

|---|---|---|

| Investment Objective | In line with the underlying fund | In line with the underlying fund |

| Investment Exposure | In line with the underlying fund | Similar to the underlying fund, except part of the money will be held by the insurance company in cash to facilitate the switching process |

| Fees and Charges on Investment Choice Level | In line with the underlying fund | On top of the underlying fund charges, the insurance company will apply an extra management / administration fee (around 0.5%-1%) to the investment choice |

| Unit Price | In line with the underlying fund | Different from the underlying fund |

| Investment Return | In line with the underlying fund | Different from the underlying fund |

| Information of Investment Choices |

|

|

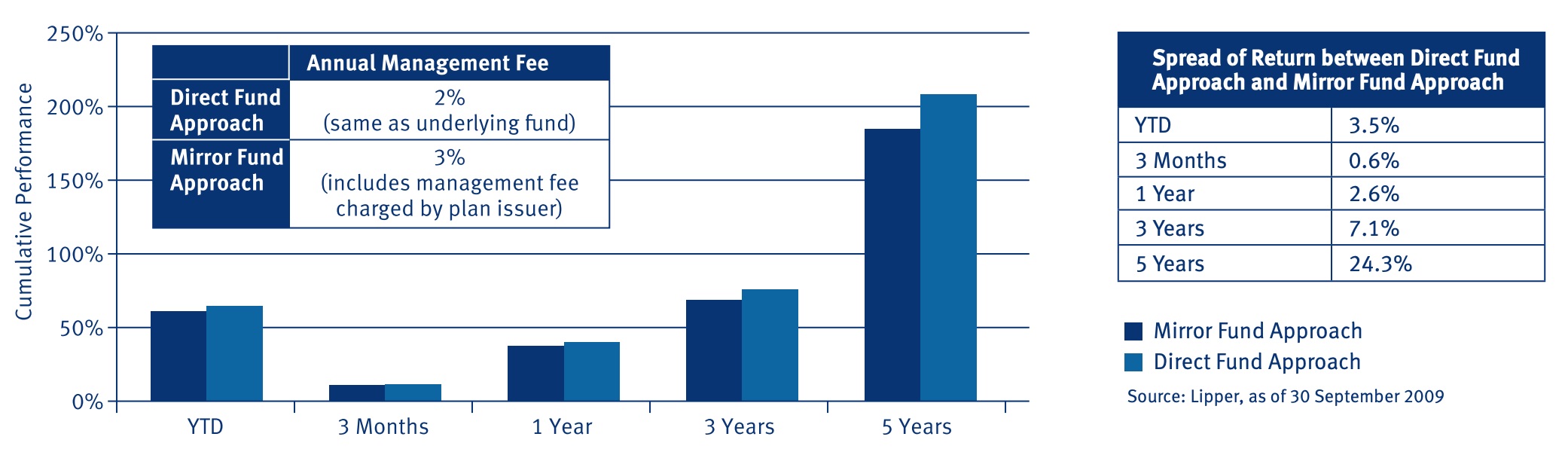

Impact of extra management or administration fee on investment performance

From the following example of an investment choice investing in the China equity market, you can see that the extra management fee (1%) applied to the investment choice using Mirror Fund Approach will significantly affect the investment performance. The longer the term, the greater the difference will be in terms of the cumulative return of the investment choice using one approach versus the other.

Disclaimer: This document is intended to be distributed in Hong Kong only. The above information is for reference only and should not be relied on as advice for making any investment decisions. You should seek advice from your independent financial adviser if you have any doubt. Investment involves risks. Past performance is not indicative of future performance. Please refer to the PrincipalBrochures, Fund Fact Sheets and Offering Documents of the underlying funds for further information and its relevant risk factors.