Education series

Core-Satellite investment approach

Why investors need to diversify? What is the rationale for asset allocation?

Market movements are unpredictable. Market leaders can, and often do, fall out of favor. This uncertainty can be intimidating for investors seeking to build long-term wealth. The fact is, even the most experienced investment professionals are often unable to foresee exactly where the markets will be headed. But what investment professionals do know is that there is often a cyclical nature to these movements.

Market rotation occurs on many levels – not just among the major asset classes, but also among different subclasses of investments within each category. Every asset class and subclass exhibits differing risk and return characteristics over various time periods. Therefore, spreading investments among several asset categories with different characteristics allows for more consistent performance under a variety of economic backdrops.

Over time, a well-diversified portfolio of investments allows investors to take advantage of gains in strong-performing asset classes and reduce the impact of underperforming asset classes, thereby lessening the portfolio’s overall risk exposure and providing more stable-and possibly better-returns.

What is a Core-Satellite Approach?

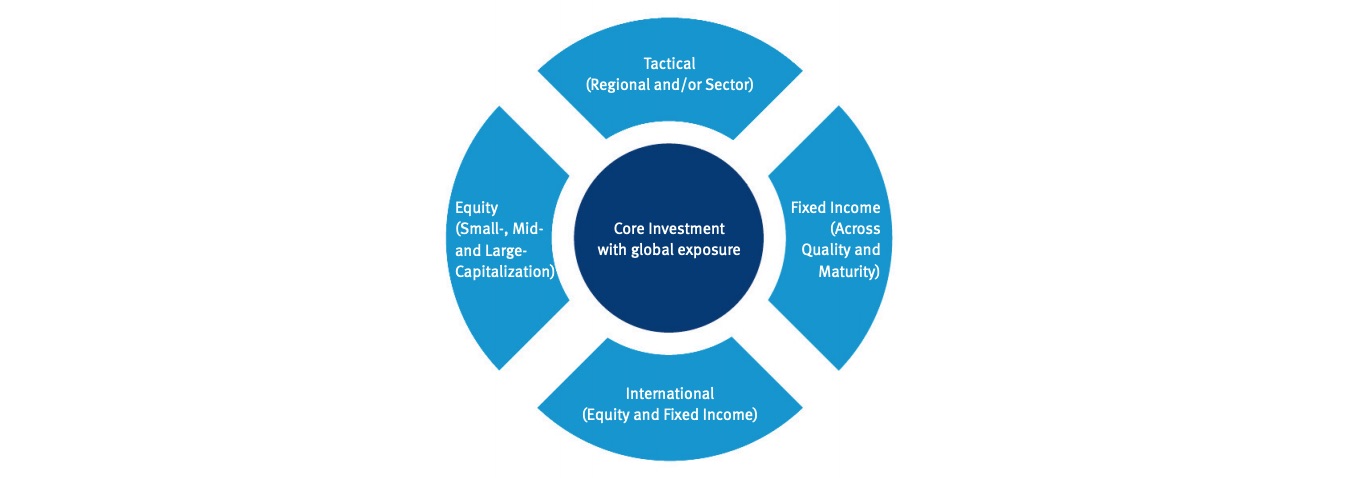

Many investors have adopted a core-satellite approach to portfolio construction, which provides a solid framework for implementing an asset allocation model. Establishing a core portfolio that is highly diversified among asset classes, market capitalizations and regions can help protect investors during market downturns, while participating in positive markets.

Investors can enhance and further customise their core portfolios by adding shorter-term, tactical, “satellite” investments, which are designed to opportunistically take advantage of market trends or special investment situations.

Investors should value flexibility, maintain diversification and be very value-oriented. In conclusion, the core-satellite approach helps investors to move beyond the basic diversification. The “core” can provide a relatively stable income stream while the “satellite” is better positioned to capture the upside of the market. This will be an all-weather coverage portfolio that is available for everyone.

Issued in Hong Kong by BlackRock (Hong Kong) Limited. This article has not been reviewed by the Securities and Futures Commission of Hong Kong. Investment involves risk. Past performance is not a guide to future performance. The value of investments and the income from them can fall as well as rise and is not guaranteed. You may not get back the amount originally invested. Changes in the rates of exchange between currencies may cause the value of investments to fluctuate. Any research in this document has been procured and may have been acted on by BlackRock for its own purpose. The results of such research are being made available only incidentally. The views expressed do not constitute investment or any other advice and are subject to change. They do not necessarily reflect the views of any company in the BlackRock Group or any part thereof and no assurances are made as to their accuracy.

BlackRock is a registered Trademark of BlackRock. © 2012 BlackRock, Inc. All Rights Reserved.