Education series

Bond Basics

Allianz

Simply put, a bond is a debt instrument. The issuer needs to pay interest to the bond holder at a pre-set rate on a regular basis and repay the invested principal on a specific date.

In other words, when an investor purchases a bond, he is effectively lending money to the issuer, which is typically a government, a private company, a supranational organisation or another type of agency. The issuer must promise, in the terms of the issuance, that it will pay interest at the pre-determined rate (i.e. coupon rate) during the lifespan of the bond, and repay the face value of the bond, which means the sum originally invested, on maturity.

The term of a bond, defined at the time of issuance, is referred to as tenor or maturity. In general, the longer the maturity, the higher the coupon rate will be. Short-dated bonds usually have a maturity of up to two years, while for medium-term bonds it is 2 to 10 years; bonds with maturity longer than 10 years are defined as long-term bonds.

Types of Bonds

By issuers

When necessary, governments or corporations issue bonds to raise funds for development projects. As such, bonds can be classified into government bonds and corporate bonds, i.e. in terms of the respective issuers.

Government bonds are issued by national or regional governments and are usually denominated in local currencies. They are considered relatively safe investments with minimum default risk as governments have the ability to redeem the bonds on maturity, since they can even raise taxes or print money, if necessary.

Corporate bonds are those issued by companies to finance their business expansion or new projects. They carry higher risks than government bonds and thus often pay higher interest to investors.

By credit quality

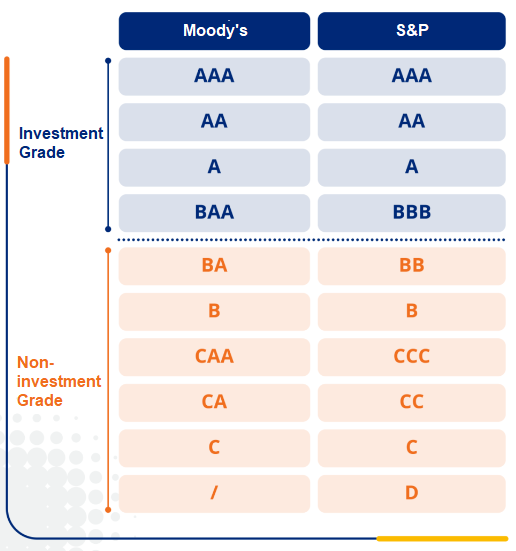

Credit ratings assigned by independent rating agencies, such as Standard & Poor's (S&P) or Moody's, reflect the creditworthiness and default risk of a company.

Ratings from AAA to BBB by S&P are considered investment grade and ratings lower are considered non-investment grade. A company with a stronger balance sheet is typically given higher rating since it has a lower chance of default, whereas those in weaker shape financially are rated lower because of the relatively higher risk of default.

When investing in bonds, investors also take the risk premium into consideration. To appeal to potential buyers, non-investment grade bonds tend to offer higher yields compared to investment grade bonds and hence they are also called high yield bonds.

| Important Notice Information herein is based on sources we believe to be accurate and reliable as at the date it was made. We reserve the right to revise any information herein at any time without notice. No offer or solicitation to buy or sell securities and no investment advice or recommendation is made herein. In making investment decisions, investors should not rely solely on this material but should seek independent professional advice. Investment involves risks, in particular, risks associated with investment in emerging and less developed markets. Past performance is not indicative of future performance. Investors should read the offering documents for further details, including the risk factors, before investing. This material has not been reviewed by the Securities and Futures Commission of Hong Kong. Issued by Allianz Global Investors Asia Pacific Limited. Investing in fixed income instruments (if applicable) may expose investors to various risks, including but not limited to creditworthiness, interest rate, liquidity and restricted flexibility risks. Changes to the economic environment and market conditions may affect these risks, resulting in an adverse effect to the value of the investment. During periods of rising nominal interest rates, the values of fixed income instruments (including short positions with respect to fixed income instruments) are generally expected to decline. Conversely, during periods of declining interest rates, the values are generally expected to rise. Liquidity risk may possibly delay or prevent account withdrawals or redemptions. Allianz Global Investors Asia Pacific Limited (32/F, Two Pacific Place,88 Queensway, Admiralty, Hong Kong) is the Hong Kong Representative and is regulated by the Securities and Futures Commission of Hong Kong (54/F, One Island East, 18 Westlands Road, Quarry Bay, Hong Kong). |