Long term investing

The financial market has experienced significant volatility over the last few years due to a number of key global events. The subprime crisis, credit rating downgrades Eurozone debt crisis and rising unrest in the Middle East have all had a negative impact on the different types of investments.

Short-term market volatility is unavoidable and unpredictable but could be manageable depending on your investment time horizon. However, history shows that in the long-term, investments into equities and bonds may outperform cash significantly. Therefore, if you remain invested, it may help you ride out volatility and capture long term potential gains.

During the time of the market uncertainty, fear can affect the investor psyche which can lead to the selling off of their investments irrationally. This often means investors sell off their investments at the worst possible time, moving into cash and ceasing any future investment into the market until uncertainty disappears. When the market stabilises and the investor moves back into the market, they purchase assets at a much higher price and possibly missing out the potentially sizeable gains that can take place when the market rallies.

Understanding how investment perform

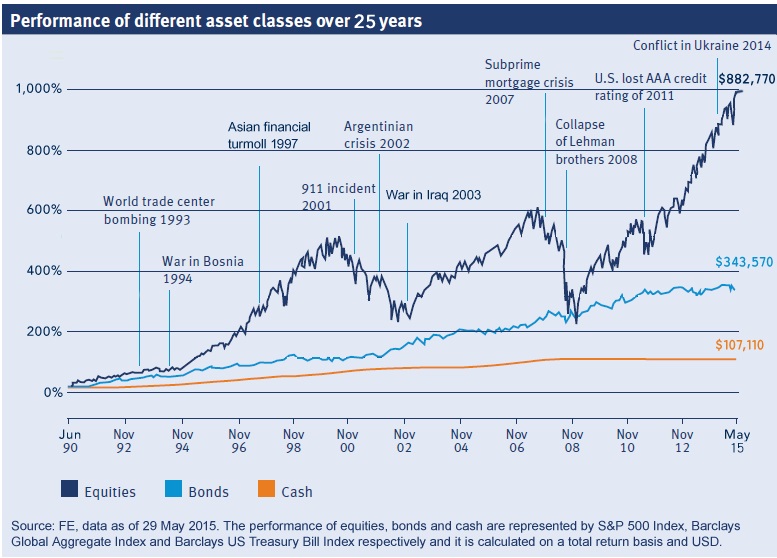

The chart below shows an investment of $10,000 into the US equity S&P 500 index on 1 June 1990. Even with the given market volatility, the investment grew over 10 times its original value by the end of May 2015 and also outperforming the same investment into cash or bonds. Actual returns are dependent on investor’s specific circumstances and asset allocations.

Be diversified

In addition to a long-term investment approach, diversification is another important factor when it comes to managing your portfolio – one which can help lower volatility.

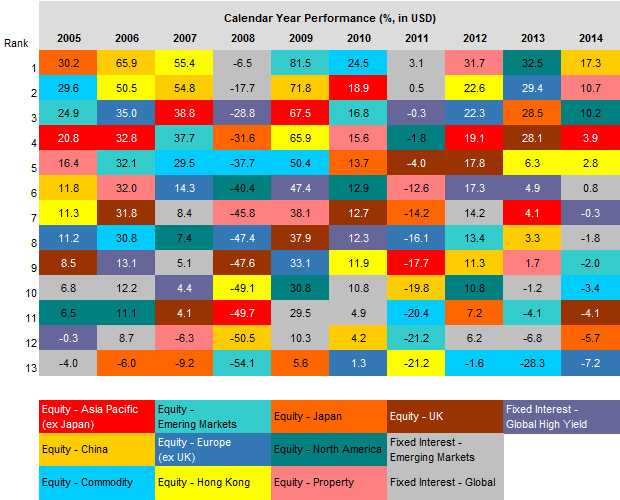

Past performance tells us that various investments tend to perform differently under the same market condition and there is no asset class that could provide constant positive returns across different market cycles. The chart below shows the average performance of relevant funds under the respective asset class.

Source: FE. The percentage shown for each asset class represents the average performance of the funds authorised by the Securities and Futures Commission under the respective asset class in different calendar year.

Rather than trying to pick a single asset class, diversifying across all asset classes may decrease your investment risk and enhance the long term return potential.

Asset allocation is the key for building a well-diversified portfolio for a long-term investment horizon. Spreading investments across different asset classes that have low correlation based on your investment objectives and risk appetite can help you optimize the risk and return tradeoff on your portfolio. It may enhance the potential to invest in the best performing asset class while reducing the impact of investing in the worst-performing asset class – eventually smoothing out your returns.

Disclaimer:

This document is intended to be distributed in Hong Kong only. The above information is for reference only and should not be relied on as advice for making any investment decisions. You should seek advice from your independent financial adviser if you have any doubt. Investment involves risks. Past performance is not indicative of future performance. Please refer to the Principal Brochures, Fund Fact Sheets and Offering Documents of the underlying funds for further information and its relevant risk factors.